Basic Stats

– Issuer: Chase

– Logo: Visa

– Points earned: Ultimate Rewards

– 1 pt per dollar on all purchases

– 2 pt per dollar on travel & dining

– 3 pt per dollar on dining (1st Friday of every month)

– Foreign transaction fee: no

– Chip + PIN: yes

– Annual fee: $95

Current sign-up bonus

– 40,000 (50,000 as of 11-17-15) bonus points after $4000 spend in 3 months

– 5,000 bonus points with addition of authorized user

– 1st year annual fee waived

The Chase Sapphire Preferred is the gold standard in premium credit cards. It’s been around a long time and has remained a good deal for years. Chase has a reputation for excellent customer service and Chase Ultimate Rewards (UR) are the single most valuable points out there. Besides being incredibly versatile, UR points do not expire and they can be transferred among your accounts, any business accounts you may own, and your spouse’s account for free. Besides the sign-up bonus and regular spending, you can also rack up UR points be using Chase’s online shopping portal, which will get you at least 1 extra point per dollar at most major online retailers.

And remember, the minimum bonus spend also counts towards regular points accrual, so by the time you get the bonus for this card, you will have earned at least 44,000 54,000 UR points. Add an authorized user when you apply and make one purchase with the second card for another 5,000 bonus points. Make some of those purchases at restaurants or hotels and you can get to 50k 60k quite easily.

Here are some examples of how you could use the UR points you earn from this card:

- 3 nights at Hyatt Andaz Peninsula Papagayo Resort in Costa Rica; $1695 worth of lodging for 45k Ultimate Rewards transferred to Hyatt Gold Passport

- One-way business class on Canada Air 787 Dreamliner, Minneapolis to Zurich; A $5006 flight for 57.5k Ultimate Rewards transferred to United Mileage Plus

- Round trip from the continental U.S. to the Caribbean in economy class; 35k Ultimate Rewards transferred to United Mileage Plus

- Depending on where and when you fly, 49k Ultimate Rewards transferred to Southwest Airlines could get you 2 round trip flights.

49k59k from your bonuses & required spend gets you$588$708 in travel from the Ultimate Rewards Travel Booking service49k59k from your bonuses & required spend is also worth $490 $590 credited to your account. This is the least efficient redemption method, but you could use it if you really want the cash.

My experience with the Chase Sapphire Preferred

This was the first “premium” credit card I applied for, way back when I was starting out and mainly focused on getting my debt on to 0% interest cards. I figured as long as I was apping cards, I should go for one with a nice bonus and points program. Creditkarma says the average credit score to get approved for the Sapphire Preferred is 730. I was right around 760 and got instantly approved online. My wife applied at the same time and was also approved online.

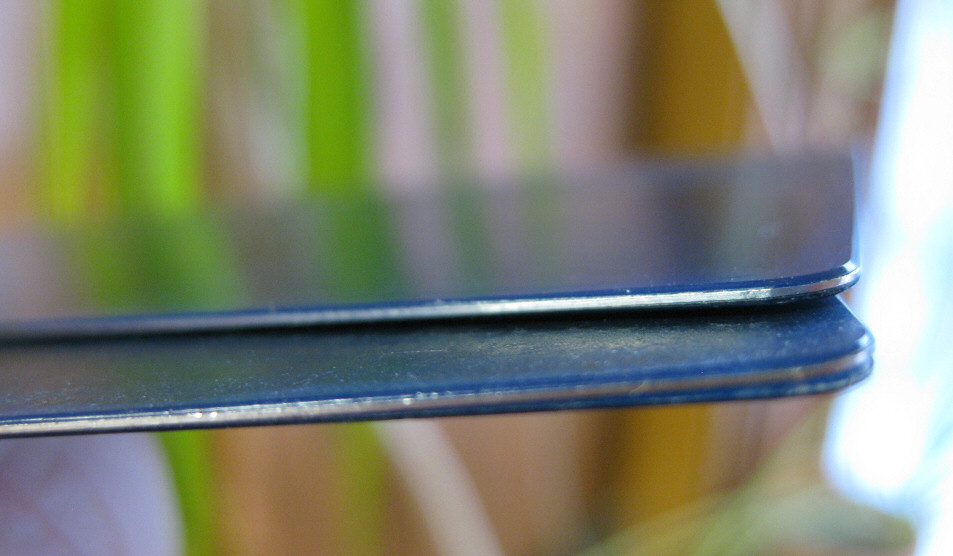

When we got our cards in the mail, we were pleasantly surprised at how cool they looked! (Trust me, once you’re a full blown card fanatic you’ll care about how they look, too). The unique thing about the Chase Sapphire Preferred is that it’s metal. That’s right, not only will this card get you some valuable points, but it may save your life someday if you ever get shot in the wallet. We still enjoy the comments we hear when handing the card to a cashier to pay for something.

We both hit our bonus spends and the points earned eventually funded my very first points redemption, airfare to Europe with UnitedPlus miles transferred from Ultimate Rewards. UR points have bailed me out several times since then, with their incredible versatility (Ultimate Rewards can be transferred to 11 different partner programs.)

My wife ended up downgrading her card to the regular Chase Sapphire to avoid paying the annual fee after the first year, but I have paid the fee twice on my Sapphire Preferred (a rarity in this game). It hasn’t left my wallet in 3 years and is still my go-to card for dining purchases.

GET THE CHASE SAPPHIRE PREFERRED

I’m not cool enough to have credit card affiliate links but I can get bonus points of my own if you apply through my referral link. If you got some value from my review, I would appreciate it very much if you applied through the link, which has the same terms and bonus as the public offer.

Click here to apply for the Chase Sapphire Preferred!

Even if you don’t use my link, I highly recommend this card to anyone as it offers a nice pile of Ultimate Rewards, no foreign transaction fees, 2x points on travel and dining, and no annual fee for the 1st year.

Just got this card and hoping I can get the points in time. Thanks for the ideas on what I can use them for!

Great read! I spent the last year abroad in Asia and was so happy to return just to get this card and then start my next year of travels. Unfortunately, I got declined. I have a 785 FICO score and was still turned down because I don’t have a real credit card history (only one secured card from Wells Fargo for college students). So I guess I can be seen as a liability. I just applied for the Chase Freedom and got accepted for that one.

For the CSP, I even called the reconsideration hotline and got the same answer, which really sucks.

What would you recommend I do? I should only be at 3 credit card inquiries but am really worried about being turned down. My plan is 100% to get chase cards first (Hyatt Gold Passport and IHG are looking the best to me), what do you suggest?

Hello Ehsanul,

You’re doing the right moves by front-loading Chase cards into your strategy. Lack of credit history can be a big road block. Luckily the solution is a simple one, but it does take some time. Obviously you need to build that credit history, and getting approved for the Freedom is a great step in that direction. Above all, make sure you never miss a payment. The fastest way to build credit now is to use your cards (the Freedom and the bank secured one), pay them both off (on time) each month, and keep your total debt to credit below 15%. If you already have a high FICO score, a couple months of responsible use on a credit card will go a long way.

Best of luck!

All those things I will do for sure. Do you have suggestions on what I should do in terms of cards specifically? I’m not a big spender but have some things to buy so most of the minimum spending on all these potential cards will be met no problem.

I am doing intensive research and it seems like the IHG Rewards and Hyatt Gold aren’t subject to 5/24……just yet (Probably due to the partnerships they have with Chase)…I think I will call back to Chase in a week or two and ask them to look over my card again, hopefully will get accepted. If not, time to move on I guess. The Sapphire Reserve will come out in 10 days and we shall see if it is subject to 5/24.

In terms of actual cards, do you have the United MileagePlus Explorer or Southwest Airlines Rapid Rewards Premier cards? I mean since you are in the UR area…

Also, few other cards I plan to get to within the next year (AMEX Gold Delta SkyMiles, BoA Alaska Airlines Visa, Bank Americard Travel Rewards, CapitalOne VentureOne Rewards)….Do you have any input on any of these cards?

Thanks so much!