I recently tallied up all the cash back, deferred interest, purchase reimbursements, airfare, and hotel stays that we’ve received from 3 years’ worth of points-earning credit cards. The results shocked everyone who’ve seen them, including myself! Jump ahead to my data or read some background information on how I derived these numbers…

Quantifying the value of points and miles is difficult. Many bloggers regularly publish lists wherein they try to estimate the value of a variety of points and miles. These are useful for comparing the relative worth of different points and miles, but sometimes I question the absolute values they come up with. They base their estimations off theoretical redemption values, which is tricky to do accurately.

Every points/miles redemption comes with opportunity costs. Every points transfer comes with risks. The cash price of award seats and hotel stays fluctuate in the time between booking and flying/staying. For this reason I decided to do my analysis empirically instead of theoretically. The data set I used was Nicoleen’s and my history of points and miles redemptions from the first three years (roughly) after getting the sign-up bonus on our first points-earning credit card.

How I measured value

As I discussed in this post, there is no perfect method of measuring the value of redeemed points and miles. For certain types of redemptions (most notably business and first class airline tickets) one could make the argument that the amount of money I saved by using miles to book the ticket has to be less than the cash price of the ticket. After all, had I paid cash I wouldn’t have paid the exorbitant price of the business or first class ticket; I would have bought an economy class ticket. On the other hand, I did receive the benefits and experience of flying in the premium cabin, so looking at it this way is an argument for counting the cash value of the actual experience I received.

Furthermore, without using value tactics to book the flights and/or lodging, there are certainly several trips I wouldn’t have taken at all. In those cases, you could argue my savings was $0.00. I saved nothing on the trip because I wasn’t going to pay for it in the first place. But then you could just as easily argue that since the whole trip was a “bonus,” it was actually more valuable than the cash price because of the excitement of going on a trip I couldn’t normally afford.

In my own case, I redeemed some miles for extremely high mile:dollar ratios, such as the $9821 one-way, first class tickets to Europe last summer. I also had some fairly wimpy award redemptions, like when I used a free night certificate on a $198 hotel stay. The same certificate could have been used at properties with $1000+/night price tags. The efficiency level at which I have spent my points and miles is varied, but all in all I think I have a pretty reasonable redemption profile.

One last note before I present the data: Although I tallied up all our redemptions and come up with an overall average value per point, this figure is really just for fun. The real purpose of this post is to silence the skeptics and show that messing around with credit cards, points, and miles IS WORTH IT! As I tell my friends over and over, the effort they see me put into this game does not represent the effort they would need to exert to get the same results. I have the additional tasks of writing this blog, helping others with points redemptions, reading enough other blogs and forums to fake like I’m an expert, and developing tracking tools and spreadsheets specifically so that you can skip the “is it worth it” assessment. I’ve done the math for you and it’s worth it! Read on for proof…

The Data

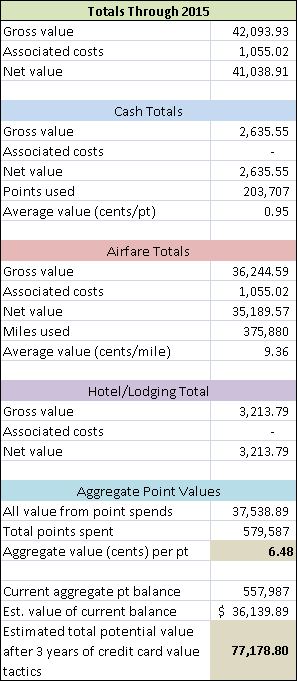

Here’s the summary table. Explanations are below.

Totals is pretty self explanatory.

Cash Totals includes all cash or cash equivalent in the forms of bonuses, reimbursements, category cash back/reimbursements, etc.

Airfare Totals is self explanatory.

Hotel/Lodging Totals is self explanatory. I used the room rate for the premium room if the stay included an upgrade to that room type as a result of status we only had by having active credit card accounts.

Aggregate Point Totals includes only redemptions paid for with points. For example, free night certificates were not included because no points or miles were used.

I added our current point balances to the total points we already spent. This number represents the total points we earned in about a 3 year period. I then applied the average aggregate value per point to this number to come up with the $77,178.80. This is the value of points redemptions we could theoretically receive with our three years of playing the credit card game!

I also totaled the estimated savings we got by shifting our revolving balances to cards with interest free promotional periods. I use the interest rate we were paying on the single card out entire balance was on when we started getting new cards as the bench mark. We’ve saved an estimated $1,774.94 in interest in 3 years of opening new cards!

Stay tuned to a future blog post where I will delve deeper into which cards and programs earned us the most value, how much our average credit card application was worth, what this has done to our credit scores, and more!