A few weeks ago I was ready to cancel my Citi ThankYou Premier card. The $95 annual fee was coming due and I didn’t feel like calling to fish for a retention offer. Fast forward to today and it’s my daily spender! How did this happen? Read on to find out. . . (And find some tips that might make you rethink your own keep/cancel decisions.)

Card Basics

Citi has 3 primary versions of its ThankYou series cards. The ThankYou Preferred card is the no-annual-fee version, which I won’t discuss because it is below us. The ThankYou Premier is the premium version, discussed in this post. And at the super-premium level is the ThankYou Prestige. Here are the basic stats of the Premier:

- Earns 1x ThankYou point on all purchases, 2x on dining and entertainment, and 3x on travel (very generously defined) and gas.

- No foreign transaction fee.

- $95 annual fee

- The sign-up bonus has varied. It has been:

- 50,000 in 2 chunks, 30k and 20k (the second one after paying the second year’s AF)

- 50,000 after $3k spend and 1st year AF waived

- 50,000 after $4k spend and 1st year AF waived

- 60,000 after $3.5k and 1st AF waived

The Premier’s “super-premium” big brother, the Citi ThankYou Prestige, was in demand last summer and fall because of an elevated 75k TY point bonus. The Prestige comes with a suite of benefits that make the $450 annual fee palatable, especially in light of the whopping 75k bonus. For a full list of benefits of the Prestige, check out MileValue’s report on the card and offer. The Prestige comes into play with my decisions on the Premier, as you’ll soon see. . .

Brief history of my Citi ThankYou Premier

I got my Citi ThankYou Premier in the fall of 2015 when the bonus was 50k points for a $3k spend. The annual fee was waived the first year and I successfully called for a redemption offer when the 2nd year’s fee was due. Although the 3x points on gas was a really nice benefit, I wasn’t really using the card anymore and I had used up all my orphan ThankYou points. I figured it was time to cancel and start the timer for the next time I could get the bonus on this card.

The plan was fine until Citi implemented their new 24 month rule for sign-up bonuses. Read all about all of the major banks’ restrictions for getting sign-up bonuses in my post here. In short, opening OR closing any Citi ThankYou card resets a 24 month timer for getting a sign-up bonus on any ThankYou card. If I cancelled my Premier, I would be ineligible for the bonus on the Prestige for 24 months. And the bonus on the Prestige had just bumped up to 75k!

When banks put in new restrictions on bonuses they are retroactive, meaning my original opening of my Premier was the start of my 24 month clock. I wanted to apply for the Prestige but I had to wait until mid-November 2017. Once I was approved for the Prestige, I could cancel the Premier before the annual fee posted. Wouldn’t you know it: 2 weeks before I became eligible, the 75k bonus on the Prestige disappeared. 🙁 In fact, any sign-up bonus on both cards disappeared and as of today, they are both still bonus-less.

The cancellation phone call

In case the Prestige regained its bonus sometime in the next year I wanted to be eligible for it, so I figured I’d give it a shot: If I got a good retention offer I’d keep the Premier open another year. If not, I’d cancel it and start the 24 month timer over. (Remember the 24 month timer extends to any card of the same point type.)

As I first announced on the ValueTactics Facebook page (please like it!), they gave me an offer I couldn’t refuse: A $95 credit that would cover the annual fee, and 1000 bonus TY points if I spent at least $1k on the card in each of the next 3 months.

In itself this offer isn’t that good. 1000 bonus points is worth maybe $20-25. I consider the $95 credit to cover the annual fee to be the bare minimum to keep the card open. However, the 3x $1,000 spends aren’t anything to sneeze at. In my case though, I had no other bonus spends to work on, so I figured I could make this my daily spender for 3 months without much trouble or opportunity cost. A hidden value in keeping the card open another 12 months is the outside chance that the Prestige gets another big bonus offer, in which case I’d still be eligible.

Sweetening the deal

As I said, putting $3k on this card over the next three months isn’t a big inconvenience. I will definitely use it for all gas purchases, earning me 3x points per dollar. At a minimum, I’ll end up with 4,000 ThankYou points (3k for the $3k spend, 1k bonus) and another year of credit history on this account. However, it doesn’t end there. . .

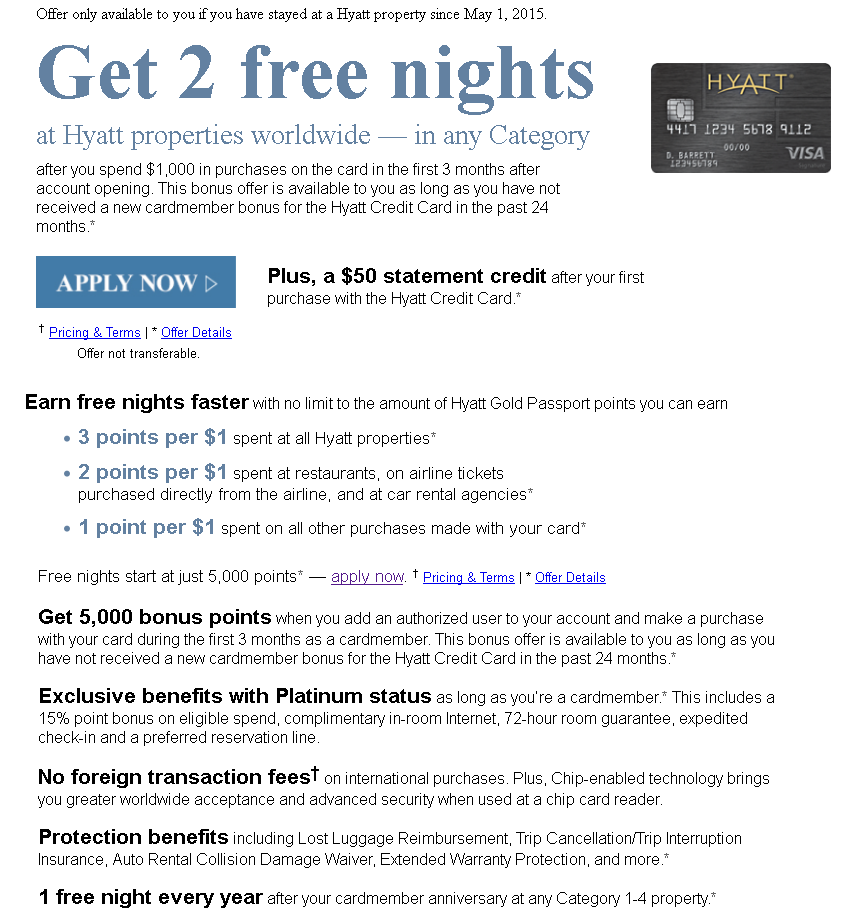

I got a few mailers and e-mails with bonus point promotions that I otherwise would have ignored. One of them is a 5x category bonus:

I probably won’t end up with many bonus points from this one. I’m certainly not going to make any purchases I wouldn’t have otherwise made. But as my Citi ThankYou Premier will be my daily spender through March, if I happen to spend in any of these categories, lucky me!

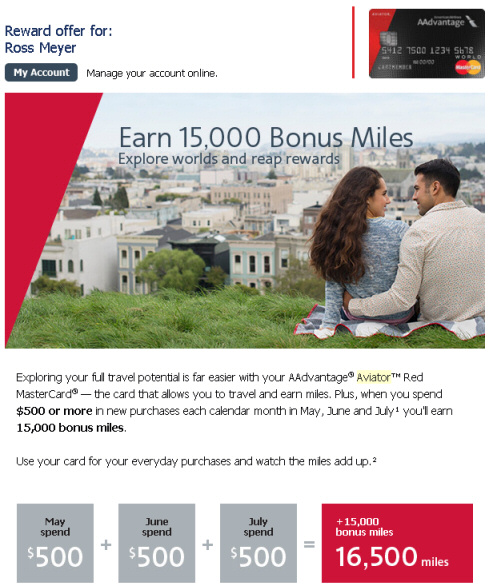

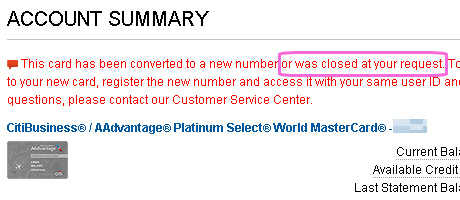

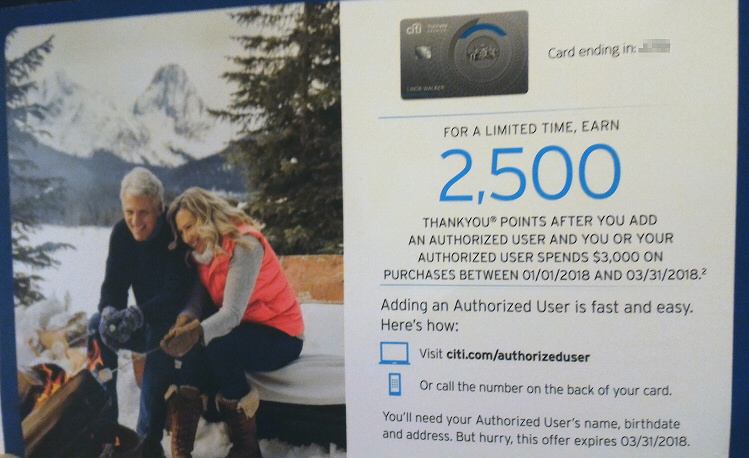

Here’s the other offer I got as a mailer:

$3k spend in 3 months? Well, that’s easy! I’m already doing that! Not to run afoul the Chase 5/24 rule, the authorized user was my daughter. We should get the card any day now.

Here is why this card has new life for me:

- $3,000 retention offer spend + 1000 bonus points = 4k pts

- 2,500 bonus pts for authorized user after $3k spend = 2.5k pts

- Bonus 5x on select categories, coupled with the card’s usual 3x on gas = potentially worth 2-5k extra

Lessons learned

- Always call for a retention offer on a card you’re about to cancel. You never know what they might offer you!

- Some cards tend to produce many bonus offers that can add up to sizeable points accumulation. (See this post on the last time this happened to me.)

- The best laid plans often go awry. Nothing you can do about this one other than to keep making those plans! Most of them will stick.

Click Here for FlyerTalk’s thread on the card to check the current bonus (if any), or you can try to decipher DoC’s spreadsheet here.