I recently did my monthly update to my big credit card spreadsheet and discovered I had two cards with annual fees about to hit. After a brief analysis I decided that at least one of them, my Capital One Spark Business, had to go. I had never cancelled a Capital One card before so I had no idea what I was in for.

The Card

The Spark Business from Capital One was my first card from that heavily advertised bank. “What’s in your wallet?” Not many Capital One cards. For reasons I won’t get into right now, they have historically been relatively unpopular with those of us playing the credit card game.

In a nutshell, the Spark Business earns 2% cash back on all purchases. The sign-up bonus after spending $4.5k in 3 months was $500 cash! That’s a pretty sweet deal, and the 2% cash back isn’t bad either. But in my case, I wasn’t putting much regular spending on the card so the $59 annual fee wasn’t worth it for me. The fee was waived the first year, but my first year was almost past. It was time to cancel.

Easy (and fast!) Cancellation

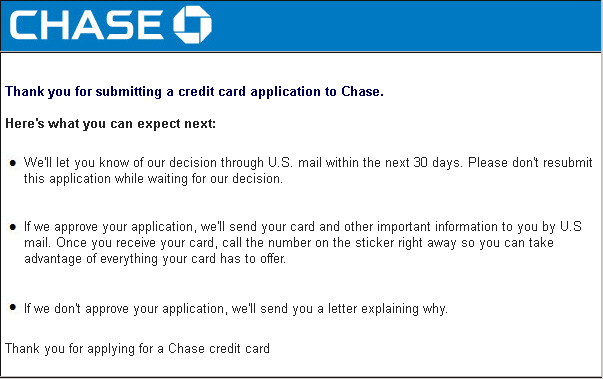

I always dread cancelling cards. This is an irrational dread since most of the time it’s pretty painless. But once in a while you’ll get a customer service rep who wants to convince you to keep a card. If you don’t make your intentions clear right off the bat, you’ll have to endure their run-through of the card’s benefits, or their pitch to downgrade the card or convert it to another type altogether.

In some cases, you’re fishing for a retention offer, so the personal customer service is what you want. But other times you know you want to cancel and you just want to get it checked off your list. In those cases, the human interaction could bog things down.

A few months ago I wrote a blog post about how easy it is to cancel Citi cards online. At the time this was my only experience cancelling a card impersonally. (After all, who really wants to talk to a human when you could hide behind digital anonymity!) When I called Capital One to cancel the Spark Business I stumbled upon an even easier way to cancel cards!

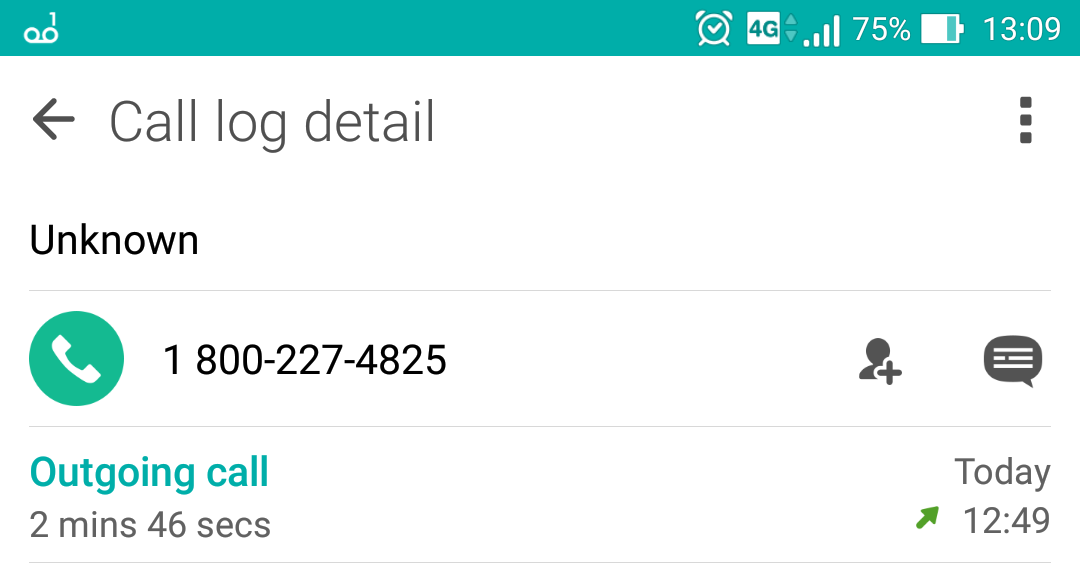

I prompted the automated phone system by saying the reason for my call was: “close account.” After I verbally affirmed a few things, the system read me a description of what closing the card would mean. It even proactively notified me that any annual fees posted to the account in the past 30 days would be automatically refunded. (A nice reassurance even though my fee had not yet posted. Overall the call took less than three minutes!

As far as I know, only Capital One allows card holders to perform a credit card cancellation over the automated phone system. I’m sure it was faster than cancelling my Citi card online and it was even more impersonal . . . if you’re into that sort of thing.

If you’ve had similarly convenient or quick experiences cancelling credit cards, please let me know by commenting on this post or on the ValueTactics Facebook page.

Thanks for reading!