A few nights ago I had an AOR (app-o-rama) and applied for 3 cards, including the Marriott Rewards Premier from Chase. Unless something changes in Chase’s 5/24 policy, this may be my final Chase application for the rest of my credit card career. As I discussed in this post, the policy says that if you have 5 or more new card applications (from any card issuer – not just with Chase) in the past 24 months, you will be summarily denied on any Chase application.

I have opened 9 new credit cards in the past 24 months, so I’m well beyond the 5/24 limit. But the rule goes into effect for Chase co-branded cards some time this month (April), and I applied for the Marriott card on March 31st. I didn’t particularly want this card but I figured it was my last chance to get any Chase card for the foreseeable future, so I picked the best current promotion that I was eligible for and gave it a shot.

My philosophy is to never apply for just one card so I shopped around for the best current promotions at other banks that I was eligible for, and here’s what I came up with:

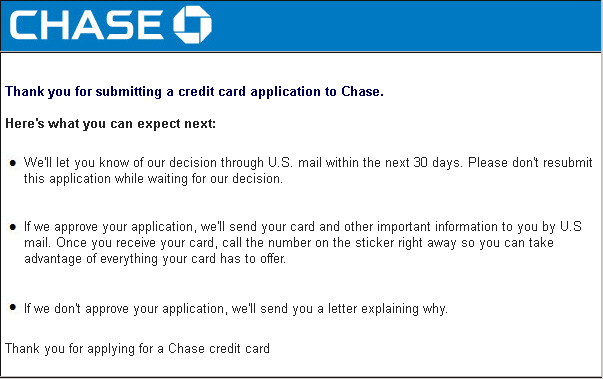

- The Chase Marriott Rewards Premier card: 80,000 Marriott Rewards points (+7,500 for adding an authorized user) after spending $3k in 3 months. $85 annual fee not waived the first year.

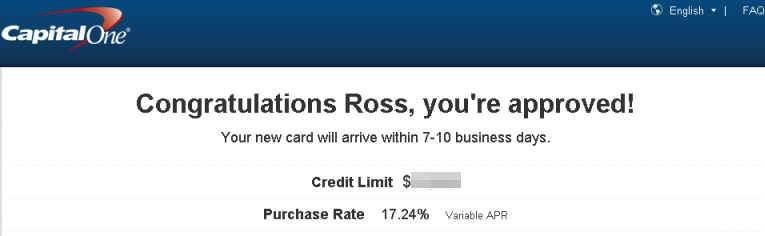

- The Spark Cash for Business from Capital One (gasp!): $400 cash back (+$90 for meeting the spend) after spending $4.5k in three months. Annual fee waived the first year.

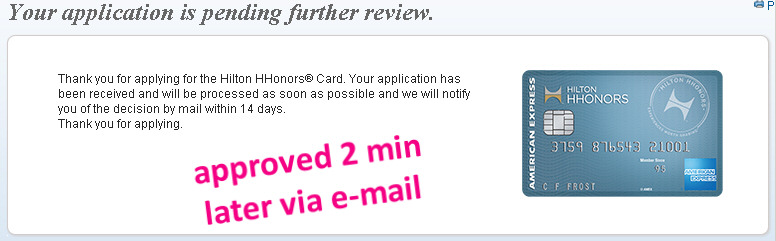

The Starwood Preferred Guest card from American Express: An unprecedented 35,000 point bonus after $3k in 3 months spend.MASSIVE FAIL (read about it here), so instead…- The Hilton HHonors card from American Express: 75,000 Hilton points after spending $1k in 3 months. No annual fee.

And here’s how the applications went:

Two out of three instant approvals at this stage in my card career isn’t bad! If I end up getting denied for the Chase Marriott Rewards Premier it will be very interesting to see what the reason is. Will the 5/24 rule be applied when the application is reviewed even though the application occurred in March? When exactly in April will the rule go into effect? Well, for my sake I hope these remain a mystery because I want to be approved 🙂

No matter what the result of the Chase application I have some serious spending requirements to meet in the next three months. If I have to get creative it will probably be a good time to write an article or two on how to meet minimum spends. As always, I’ll keep you posted…

Links to the card offers mentioned here:

Chase Marriott Rewards Premier

Capital One Spark Cash for Business

American Express Hilton HHonors card (offer expires 05/04/16)