I’ve been using the credit card tactic to earn points and miles for about 5 years now. This tactic has earned me thousands of dollars in cash and tens of thousands of dollars worth of free travel. I’ve had a good run! The vast majority of the points and miles I have earned were not from regular spending, but from the credit card’s sign-up bonus. But the rules for credit card sign-up bonuses are getting tighter all the time.

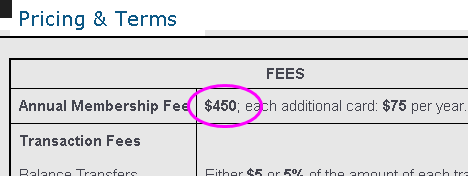

Each credit card has its own requirement in order to get the sign-up bonus. The most common requirement is a certain amount of spending on the card in a given time period, typically the first 3 months of card membership. The bonus on each card can change periodically and is advertised on whatever page you click through when you apply for the card. However, just because you’re approved for the card and make the required spending doesn’t mean you’ll get the bonus!

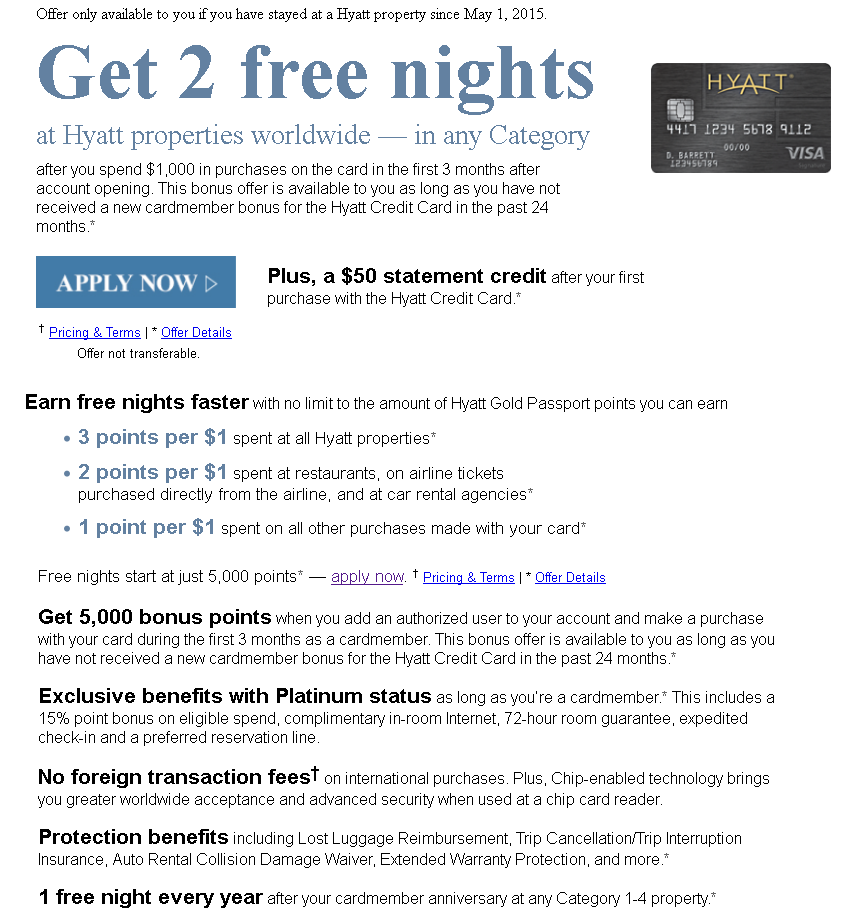

An example of a card’s “splash page,” listing the bonus and other benefits of the card. Chase’s rules only allow you to get the bonus on their Hyatt card every 24 months. The 2 free night deal seen here has been replaced with a 40,000 point bonus, and the $50 statement credit comes and goes.

Most of the following rules only apply to someone who has already earned the bonus on a particular card once before. Getting a repeat bonus on a particular card is called card churning.

Current rules for sign-up bonuses

Each issuing bank has their own set of rules for if and how often you can get a sign-up bonus. These rules for credit card sign-up bonuses have changed a lot in the 5 years I have been in this game. I can’t think of a single example of a rule loosening up! Like most complex systems, things only tend to get more restricted and more narrowly defined.

Chase

Chase is a points and miles powerhouse, with co-branded cards with United Airlines, British Airways, Southwest, Hyatt, Marriott, and International Hotel Group. Chase also has their own transfer points, Ultimate Rewards, which are highly valuable due to their transferability. Even getting approved for a Chase card has its own extremely limiting rule called the 5/24 rule. If you can get approved for a Chase card, here are the rules on getting the sign-up bonus:

- You cannot get the bonus if you already have that card (i.e. you can’t have two copies of the same card).

- You won’t get the bonus if you have earned a sign-up bonus on the same card in the past 24 months. Keep in mind this 24 month timer starts when you received the bonus, not when your account was approved.

- Only one Sapphire product at a time. This is more of a card approval rule, but I’ll include it anyway since the Sapphire Preferred and the Sapphire Reserve are both popular cards for their 50k Ultimate Rewards sign-up bonuses. If you apply for any Chase card with the word “Sapphire” in the card title and you already have any Sapphire card, your application will be denied.

Citi

Citi is another golden goose of sign-up bonuses. As of this summer they no longer have Hilton co-branded cards but they still have American Airlines cards with 40-60k mile bonuses. Citi also has their own transfer points called the Citi Thank-You points. While Citi used to have very lax rules regarding sign-up bonus illegibility, they now have some of the most restrictive:

- Like Chase, Citi has a 24 month timer between bonuses on the same card.

- A few months ago Citi added some new fine print to their applications that pretty much makes the above-mentioned timer a moot point. The 24 month timer is now shared among all cards within the same point species. (For example: if you earned a bonus on the Citi Thank You Premier, you are not eligible for the bonus on the Citi Thank You Prestige for 24 months since they both earn Thank-You points.) The same goes for their American Airlines earning cards.

But wait, there’s more. . . The new language also changed the triggers that activate the timer. The timer is no longer started by earning a sign-up bonus. Instead, the 24 months start when you open, close, or downgrade an account. This is asinine because it offers extra motivation to close an account right after earning the sign-up bonus. The one saving grace is that business cards are given their own separate timer.

American Express

Amex has a horribly harsh, yet refreshingly simple rule for bonus eligibility:

- One sign-up bonus per card, per person, per lifetime.

If you have ever earned the sign-up bonus on a particular card, you are permanently ineligible to receive a bonus on that card again. For example, if you had the Amex Delta Gold card 8 years ago and cancelled it 7 years ago, you might be approved again for the card today, but you would not get the sign-up bonus.

If the sign-up bonus changes (like when the Amex Delta Gold goes up to 50k, as it does periodically) it is still the same card so you will still be ineligible. It’s different if they release a different version of a card with a different name. For example, if they stopped making the Delta Gold and instead created a new card called the “Delta 24 Carat Gold Card” then you could earn that card’s bonus even if you earned one for the old version.

Most points and miles earning cards periodically come with elevated bonuses. Since Amex sign-up bonuses are once-in-a-lifetime, wait for the best known offer on a given card before applying for it.

Bank of America

BoA is famous for it’s Alaska Airlines card, which has been the go-to card for compulsive churners for years. There are reports of people getting a new card every 2 months and earning the sign-up bonus each time. Bank of America just released it’s new Premium Rewards card, which indicates they may be making a foray into the more competitive group of banks issuing premium travel cards.

- Some Bank of America cards have no specific fine print related to repeat bonus earning.

- The brand new BoA Premium Rewards card fine print says you can’t earn the sign-up bonus if you have earned it within the past 24 months.

There is evidence that BoA is starting to get wise about abusive card churning, and several recent reports indicate a general clamping down, like the 24 month timer on the new Premium Rewards card. It’s still fair to say that Bank of America cards are more churnable than not, but let common sense be your guide on when to try for a repeat bonus on cards without specific language.

Barclay

Barclay has several good points and miles cards including the Arrival Plus and the American Airlines Aviator series. Barclay has no publicly defined policy on bonus eligibility for many of their cards However, Barclay seems to have more of a human touch when it comes to approving new accounts. Unless you leave some evidence of regular and legitimate card use, it may be difficult to get approved for a new card, especially if you appear to be doing it just for the sign-up bonus.

Is the situation getting worse?

Yes. It’s not the Wild West anymore. Many value tacticians who have been around longer than I have remember the days when you could get 4 different versions of an American Airlines card from Citi every 6 months, racking up 300-400k miles a year just from bonuses! And of course there are the ancient heroes like Pudding Guy, who found a pretty big loophole that earned him over 1.25 million miles by buying and donating $3k worth of pudding!

In my 5 years in this game I have seen a lot of new restrictions come into play. The most drastic of which have been from Chase and Citi. This makes sense since these banks have some of the most lucrative bonuses out there. They need some way of limiting people like us who pay attention to the details and want to maximize these offers. Limiting bonus earning is a key way they can do that. The other method banks use to limit churning is with rules on card approvals. I’ll address this closely-related issue in another post.

How you can still beat the game

Credit card bonuses are an incredibly valuable resource. But like all resources, they become harder and harder to extract as time goes by.

Tighter rules on getting sign-up bonuses are just one factor. Getting approved for some cards is becoming more difficult all the time as well. Points and miles, like currency, are in a constant state of inflation. Mileage devaluations and new award charts decrease the value of the points you’ve already earned. Loopholes are closing across the board at a pretty steady rate.

The solution to all this is to adapt and update your strategy. Speaking for myself, every card application for me or my wife is very carefully considered. I have a long term schedule of cards we would like to get, but it’s also flexible. Elevated bonuses come and go, rules change, and the value of particular points and miles change.

- If you’re already playing the credit card game, pay attention. If you got away with willy-nilly card applications in the past, you can’t anymore.

- If you’re still sitting on the sidelines, get in the game. I sound like a broken record but I can’t stress this enough. The crazy world of credit cards, points, and miles is getting more complicated all the time. But the opportunity is still there and still awesome! Get in while the gettin’ is good!

🙂 For those of you still on the fence about the credit card game, here’s some general motivation to get your blood pumping: 🙂

Here are some other resources with similar information (minus the awesome motivational video):

- Doctor of Credit’s List of Churnable Credit Cards

- Flyertalk wiki on Chase applications and sign-up bonuses

- Flyertalk FAQ on Citi American Airlines cards (rules apply to Citi Thank You cards as well)

Some images in this post made available through a Creative Commons license. Click here for info.

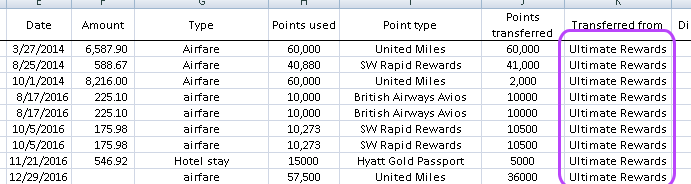

For our

For our  For my upcoming trip to Europe, I booked a Polaris Class United flight with miles transferred from Ultimate Rewards. The value of this redemption works out to

For my upcoming trip to Europe, I booked a Polaris Class United flight with miles transferred from Ultimate Rewards. The value of this redemption works out to  I am almost ready to book flights for our fall vacation. I will either be transferring Ultimate Rewards to Southwest for a value of about 1.7 cents per point, or using points at the Ultimate Rewards travel portal to buy airfare at a rate of 1.5 cents per point. Let’s split the difference and say

I am almost ready to book flights for our fall vacation. I will either be transferring Ultimate Rewards to Southwest for a value of about 1.7 cents per point, or using points at the Ultimate Rewards travel portal to buy airfare at a rate of 1.5 cents per point. Let’s split the difference and say