In this update: a 60,000 point card bonus is expiring soon, Nicoleen’s failed retention effort for a usually generous credit card, a trip report preview, and our monthly points and miles activity for October.

CARD NEWS ALERT :

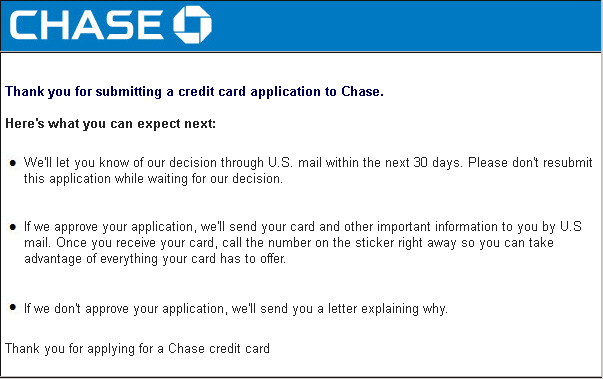

The Chase Ink Plus business credit card will be discontinued by the end of 2016. Your last chance to get the card and it’s 60,000 Ultimate Reward bonus will end shortly. A new card called the Chase Ink Business Reserve will be taking its place but since they are different products, you can get the bonus on both! (The purported bonus on the new card is 80,000 UR points). If you have been on the fence about this card, don’t delay any longer!

The Chase Ink Plus business credit card will be discontinued by the end of 2016. Your last chance to get the card and it’s 60,000 Ultimate Reward bonus will end shortly. A new card called the Chase Ink Business Reserve will be taking its place but since they are different products, you can get the bonus on both! (The purported bonus on the new card is 80,000 UR points). If you have been on the fence about this card, don’t delay any longer!

(News source and more details about the new card offer at Milevalue)

Click here to read my review of the Ink Plus, and to see how a year with the card could easily earn you over 75,000 UR points. Or, if you’re ready to apply now, please click through my referral bonus link to help support the site.

Household October Points and Miles Activity

In addition to saving $5.27 in gas between two fill-ups, here’s Nicoleen’s and my activity for October:

- earned 217 airline miles

- earned 13,330 Chase Ultimate Rewards

- earned 2,261 hotel points

Travel News

VT readers Derek and Danie have returned from their value-packed trip to Mallorca, Spain. Their round trip flights and 6 nights of hotel stays were paid for with points and miles, making the airfare and lodging virtually free! Stay tuned for a trip overview, along with details on how they got these luxury accommodations with a few credit card bonuses.

Personal Credit Card News

When U.S. Airways merged with American Airlines in 2014, the U.S. Airways credit card from Barclay was transmuted into the American Airlines Aviator card. Until now, this card had always been a pushover when it came to retention offers. When calling to cancel the card because of the annual fee, Nicoleen and I were routinely greeted by a cheerful rep who was willing to waive the $89 annual fee and usually throw in some additional points. Not so this time around. Nicoleen called three times to try for an annual fee waiver, but was thrice shot down. In the end she decided to cancel the card and have the AF refunded. To see a history of Barclay’s generous track record with retention offers for this card, and the recent drop-off of those offers, see the Flyertalk wiki here.

New ValueTactics Blog Posts

– Small Business Saturday 2016 . . . Another Year, Another Disappointment is my report on the second year in a row without a good deal for Amex’s Small Business Saturday. There is some strategy in this post about how to capture value before it’s gone!

– ValueTactics 100th Blog Post was our milestone hundredth post! It’s a big THANK YOU to my readers, and links to some highlights from the last two years.

– Geographically Specific Deals and Offers talks about what you can do if certain value tactics are not available in your country, region or state.

Now you’re updated. Go employ some Value Tactics!

It should be a pretty exciting trip, especially considering it’s almost free! We’ll get the full report from Derek after the vacation, including how he flew and stayed for free using value tactics!

It should be a pretty exciting trip, especially considering it’s almost free! We’ll get the full report from Derek after the vacation, including how he flew and stayed for free using value tactics!