This update covers about two weeks and includes my personal monthly points and miles update, a preview of some brewing travel plans, a report from a reader, and my current credit card usage decisions.

First, a look into my personal tracking. Since the previous update I have pumped $19.01 in free gas. For 2015 the percentage of my commute gas that’s free has dropped below 17%, mostly due to rising fuel prices. I recently tallied our monthly points and miles earnings. Here are the results:

- earned 9,629 airline miles

- earned 7,253 Chase Ultimate Rewards

- earned 96 ‘other’ points

Travel News

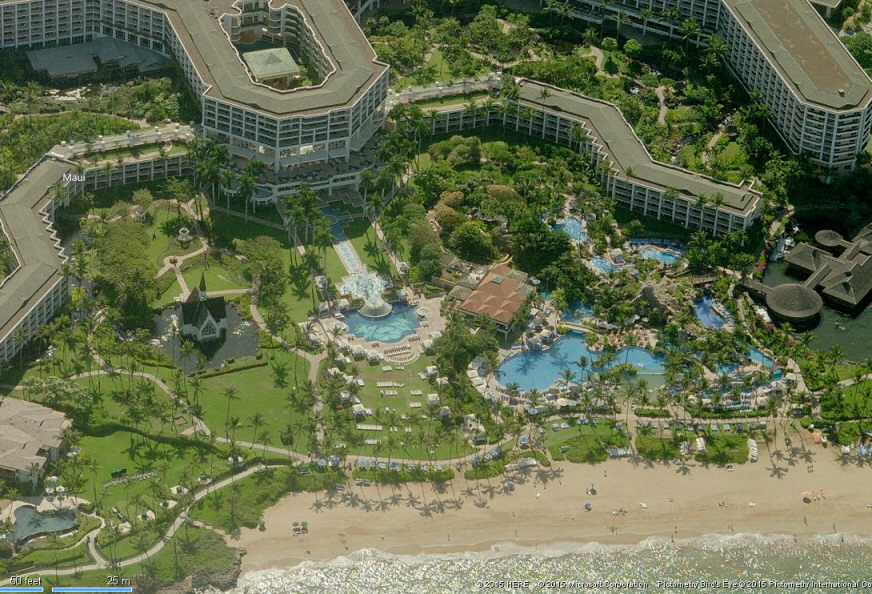

I’m getting the itch to plan a trip. We don’t have any travel plans on the books right now and it’s starting to bug me! I might have something in the works for Europe next summer, but what really gets me excited is the prospect of another tropical, lazy vacation with Nicoleen. We’re exploring the idea of a 6 night stay on Maui sometime next year. If we play our cards right (and I do mean cards), we should be able to get all 6 nights at top tier resorts for free. Of course the plan would be to get the flights for free as well. I’ll write more about this plan as it develops, but here’s a teaser of the place we have our eyes on:

Value Tactics Reader Reports

ValueTactics reader Derek reports paying just $561 for $2,984 worth of airfare! He’s flying his family of 4 to Grand Cayman Island and he accomplished this awesome deal by using the value tactic outlined in this post from onemileatatime. Nice work, Derek, and have a great trip!

Credit Card News

Nicoleen is still working on the awesome promotion on her American Airlines Aviator Red by Barclay for 15,000 AAdvantage miles for spending $500 each month in September, October, and November. I had been taking advantage of the “spend $1000, earn 1000 extra” bonus offer valid each billing cycle on my Citi AAdvantage card, but I recently got a better offer:

That’s 3x miles (vs. 2x on the 1000/1000 deal) on categories I’ll easily hit the bonus limit on, PLUS there’s no $1000 minimum per month. I’ll definitely be using this card until the bonus limit has been met. Based on my experience, it seems like this Aviator Red from Barclay (previously the U.S. Airways Barclaycard) is becoming a clear front-runner when it comes to periodic promotional bonuses. This is a targeted bonus, however, and not everyone gets the same offers. I was notified of this one via e-mail.

Now you’re updated. Go employ some Value Tactics!