Over the course of a 2-year experiment, I “bought” almost $5000 in free-after-rebate merchandise from Menards. Two garage sales and a flea market later, it’s time to analyze the data: Does it really work? Was it worth it? How much did I make? Read on to find my answers…

The Menards rebate system has been one of the major tactics I have posted about on this site. As you can read on the About Me page, a few years ago I was unemployed and looking for creative ways to make money and/or get free stuff. I stumbled upon the Menards mail-in rebate program that frequently features free-after-rebate (FAR) items in their weekly ads.

Through some testing I found that you can use the in-store rebate checks to buy more FAR items, effectively recycling the original money over and over. When you want to end the chain reaction, just use the remainder of the rebate checks on purchases you would have made anyway, and voila! You just got all that stuff for free. A more detailed overview of the tactic can be found here.

MY EXPERIMENT

As soon as I confirmed some basic plausibility (e.g the checks can be used on anything; even new FAR items) of the system I decided to run it like an experiment. I love quantifying value (hence this website!) and I wanted to see how much one could actually make by getting this free stuff and hopefully selling it secondhand (or using it). Here were my parameters:

- Get only and all items where the rebate amount matches or exceeds the purchase amount.*

- Get the max quantity of items eligible for the rebate offer.**

- Sell items at 50-75% discounts from retail (to move product fast).

*There were some exceptions, as discussed here.

**In rare cases there were not enough items in stock. Also in rare cases, there were FAR items with no limit. In this case I would get as many as I presently had rebate checks to cover.

And some assumptions:

- Stamps for sending in rebates, garage sale signage, and flea market fees are counted as expenses.

- Travel costs to and from the store do not count as expenses as these cost were negligible in my situation.

THE RESULTS

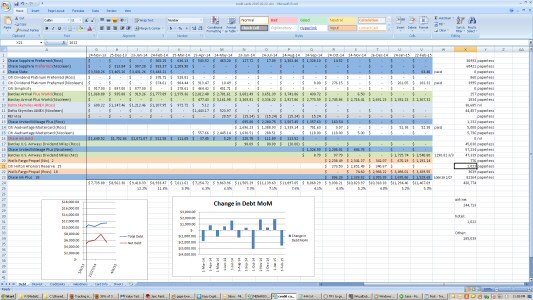

Acquiring stuff

After 2 years (July 7th, 2013 – July 5th, 2015) the total retail value of the FAR items I purchased was $4946.46. Without the few restrictions I put on my purchasing, this figure would have easily been over $5000. This puts the total amount of stuff you could acquire for free at around $2500/year.

The furthest “in the hole” I was (i.e. the most spending done before getting some rebates back) was $1039.04. However, I happened to start during a long rebate delay period, which seems to happen in the middle of every summer. Once I got the ball rolling and got some rebates in the mail, it seemed like around $400 was all that was needed to perpetually re-use the rebates. I have since used about $850 in rebates for non-experiment purchases at Menards, leaving only $185 to be paid back (by using rebates to make personal/family purchases I would have made anyway).

Selling stuff

In August of 2013 we had a garage sale. I only had about $350 in product at the time, and selling it around 50-75% off retail price I made around $50. We had a second garage sale a year later and I made closer to $155. My big plan to liquidate a lot of inventory came in June 2015 when I got a booth at a flea market in my area. A full report of that event can be found here. At the flea market my Menards stuff netted $201.81.

When anyone in my house would take any product out of inventory for personal use, I would charge the family my sale price for the item (No, I didn’t actually demand $1.50 cash from my wife when she took a spray bottle of carpet cleaner! This was just done on my tracking spreadsheet.)

Between both sales, the flea market, and the few self-purchases, my total revenue to date is $405.31. I estimate I still have 70-75% of my total inventory from the 2 years, which would suggest I have the potential to make another $945-1215 in revenue.

ANALYSIS

My data lends itself to two main conclusions:

- The system works. You can make money doing this.

- It’s probably not worth it.

The system works

You can make money doing this. All of the details of the rebate system work out so that you can perpetually buy more and more free stuff with the store’s own rebate checks. Since Menards has a lot of generally needed products, it’s not hard to “pay yourself back” when you’re ready to stop the rebate churning. The rebate program is very forgiving about mail-by dates and the ad flyers are online, making it easy to find the deals. If you have a Menards close to where you live or if you frequently drive past one, getting the merchandise and sending in rebate forms can be accomplished without much extra time or hassle.

Selling the items also works. A lot of the products are cheap, expendable items that people generally use: paint brushes, cleaning supplies, gloves, hand tools, kitchen gadgets, etc. Of course some items sell better than others but in general, the stuff goes. I tried putting a few of the higher volume items on craigslist, but never got any bites. Impulse buys at garage sales and flea markets seems to be the best bet to offload your free stuff.

It’s probably not worth it

I just explained how the system works and that you can make money. So why do I say it’s probably not worth it? The answer is simple: efficiency. No one part of the process is overly onerous but looking at it as a whole, it is just too much work for the return.

But it’s close. In fact, until I packed it all up and brought it to the flea market, it still felt like it was worth my while. But once the volume of stuff became hard to physically manage, getting it moved and set up properly to sell became a big project. If one half of the program -getting the stuff or selling the stuff- could be cut out of the equation I would probably say it was worth the effort. But as it stands, for me it is not.

That’s not to say it isn’t worth it for everyone. For someone who spends their summers hanging out at flea markets anyway, or someone who lives on a busy intersection, the selling part might be a lot less trouble than it was for me. In this case the scales could be tipped enough that the value exceeds the costs.

Another idea would be to limit purchases to only very small items like drill bit sets, paint brushes, saw blades, etc. and to avoid the gallon jugs of cleaning supplies and mini blinds, for example. Doing this would cut way down on the hassle of storing and transporting the stuff. It would also reduce the total number of trips to the store.

MOVING FORWARD

I have forced myself to take a break from Menards free stuff. It can be pretty addicting to walk out of a home improvement store every week or two with 5 full bags of free stuff. I quit cold turkey and knowingly missed some good deals. I need to liquidate more inventory before I even think about getting more free stuff. I might give craigslist a second try or put a few items on amazon. If nothing else I will do another flea market early next summer.

When I am ready to start churning rebates at Menards again I will change my tactics. I now know which items sell the best and which ones are a pain to store and transport. I think a smaller, leaner rebate churning program at Menards could make almost as much profit as my experiment did, but with a fraction of the hassle.

In the meantime, I’ll continue to leave Menards Free Stuff as a featured value tactic on the site. Maybe some reader will be in a better position to sell the product, and would therefore find the tactic valuable. Maybe someone will find a different retailer or website where the same tactic could be applied.

Buying almost $5000 of merchandise for free was sure fun. It’s time to ease up for now, but something tells me I haven’t sent in my last pile of rebate forms…