A reader recently asked me why I don’t report my gas savings on my monthly updates anymore. I still implement the free gas tactic, so why don’t I write about it anymore? It’s an astute observation and I am happy to explain my reasons:

What happened, anyway?

The free gas tactic saved me well over $1700 in two years of commuting. My tactical outline page on free gas is actually still one of my most visited pages (it needs a face lift too!). If it’s such a popular topic on the website and it has saved me so much money over the years, why don’t I talk about it anymore?

I explained some of the reasons in an update post last April. In a nutshell;

- Super America stopped double coupon Tuesdays, effectively cutting the value of the tactic in half.

- I use way less fuel. My commute is a fraction of what it was before 2 years ago. I also drive a more fuel efficient car now. Gas prices have been lower in the past 2 years than the previous 2 years as well.

- And, as I’ll explain below, I’ve outgrown the need for tracking my savings.

I’ve proven my point

Aside from satisfying my need to add everything I do into a spreadsheet, there really isn’t a good reason for me to track or report on my gas savings anymore. For some context on this reasoning, read one of my first posts laying the foundation for this website:

Tracking is the Key (and why you shouldn’t do it)

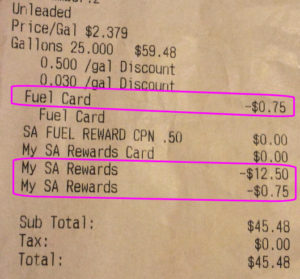

I know how much the free gas tactic is worth to me. Before the end of Double Coupon Tuesday, MySA Rewards points were worth about $2.86 per thousand points (or 0.286 cents per point “cpp”). The $0.50 per gallon fuel discount is still the best option for using these points, but it’s now only worth half.

That $12.50 discount used to be $25.00 when Double Coupon Tuesday was in effect.

The coupon is good up to 25 gallons, so on Tuesdays it used to be worth $25; now it’s worth $12.50. My SA Rewards points are now worth $1.43 per thousand, or 0.143 cpp. In contrast, using the points to buy gift cards only yields 0.1 cpp, which is terrible – the majority of credit card-earned points are worth 1.0 cpp when redeeming them for gift cards.

The $0.50 coupon comprised 80% my total gas savings. Now the coupon is worth exactly half what it was before. Whereas I used to get approximately 20% of my gas for free, I (and you) can now expect to get a 12% total savings.

Broadening the analysis, I know that when all the discounts and coupons are combined, I can consistently save about 12% of total fuel cost at Super America. This is really the final output of all my analyses. It shows me (and more importantly: you!) that the slight inconvenience of using the My SA Rewards card, running all your fuel and store purchases through gift cards, and using coupons is worth 12% of your total fuel expenditure. If that’s worth it to you, then use the free gas tactic!

What now?

As you can see, the usefulness of tracking all my savings with this tactic has run its course. Its value is now a known value (sweet pun, bro). You and I can make the decision on whether or not to utilize this tactic based on how much we value that 12% savings and how much we are averse to the inconvenience of the slight work involved.

For me personally, I still see the value in collecting My SA Rewards points but ever since the loss of Double Coupon Tuesday, whether it’s worth it to me is borderline. I sometimes buy fuel at other gas stations if it’s more convenient. Sometimes I don’t use coupons, and sometimes I pay directly with my credit card if my gift cards are low.

Other gas station chains might have different and valuable opportunities to save money on fuel. I want to hear about these! Please contribute in the comments below if you know of any.

There are so many costs that papercut you every day. Many small expenses create a continuous trickle of money away from you. Spending an extra 10 seconds to swipe a membership card every time you put gas in your car to save a few cents doesn’t seem like it’s worth much. But it’s refreshing to know that in some things, you can reverse the flow and trickle some value back into your bank account!