Adam Sandler’s character in “Punch Drunk Love” working on hoarding 1,000,000 miles through a loophole in a product label promotion. He’d better spend some before the next devaluation!

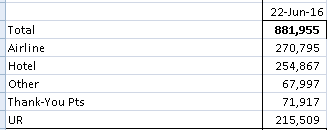

In last week’s update I mentioned that I recently realized I had close to 1 million points and miles in various airline, hotel, and credit card programs. Being a points millionaire might seem like a fun title to have, but in fact it’s dangerous. No, I don’t mean you would need a bodyguard and a home security system; I mean your huge points and miles balances are a liability because they are only worth something when you redeem them, and redeeming them gets worth less and less as time goes by.

Read on to learn the three possible downsides to building up an oversized point and mile portfolio.

1. Devaluations

Frequent flyer and hotel rewards programs routinely devalue their points by raising the average number of points needed for a given flight or hotel stay. This is their way of accounting for inflation. If the dollar’s real value is decreasing by 3.1% per year (the average over several decades), it means we’re spending 3.1% more nominal dollars per year. If every dollar we spend on a co-branded credit card earns us x points or miles, we are getting more and more redemptive power as time goes by. At the same time, the hotels’ and the airlines’ real cost of granting you the free flights and hotel nights stays the same. To account for this they raise the points needed for their redemptions.

Then there’s the unpleasant but unavoidable fact that websites like mine, other blogs, and forums like Flyertalk (along with the general increase in communication since these programs were started) are making these programs less lucrative for the airlines, hotel chains, and credit card companies. As more and more people learn how to maximize the value of these programs and work every angle down to the finest detail, the companies have to push back to maintain their profits.

There are a variety of factors that cause points and miles devaluations, but it’s a fact that they will continue to occur. No one should be surprised by this. I agree with most of the big time bloggers on the subject, where the consensus is: It’s ok to devalue your points, but don’t try to hide it from your customers. A recent Southwest devaluation seems to have done just that.

Points and miles gradually lose their value over time, so spending them sooner rather than later is one important tactic to maximize their value.

2. Mergers

Last year U.S. Airways was absorbed into American Airlines. Earlier this year it was announced that Marriott will be purchasing Starwood. Each frequent flier and preferred guest program have their unique benefits and redemption tricks. When mergers happen, these program nuances are usually lost. Sure, you may gain some new program benefits when you lose others, but on the whole it seems like the new entity always manages to come out on top.

For example, Starwood is famous for its awesome redemption rates at hotels ($0.02 per point, compared to Hilton’s roughly $0.003 per point rate). The fate of everyone’s Starwood points after the Marriott merger is still unknown, but the travel community seems to be preparing for a net loss of value.

While mergers are usually known well in advance, putting all your eggs in one basket – a basket that may get dumped into another basket – is probably not the best idea.

3. Known or unknown transgressions (account closure risk)

This one is tough. Everyone has to formulate their own ethical code of conduct when dealing with credit card bonuses and points earning strategies. I personally play it pretty safe. I don’t get new cards every three months like clockwork, I’m not into blatant manufactured spending, and in general I try to play by the rules. Of course I explore the limits of the rules, but that’s the fun part! I get a lot of value from these programs and I don’t want to risk being blacklisted. In short, I don’t want the powers that be to like me; I want them to not even notice me.

Then there are those who play hard ball. People who spend thousands a month on manufactured spending. People who get authorized user cards for their dogs and cats to get the bonuses some cards offer. People who attempt tactics such as getting the bonus spend the first day they get a card, waiting for the bonus to post, and then cancelling the card before the first month’s bill closes to avoid paying an up-front annual fee.

These people really have to worry about the future of their stored points and miles!

It’s not unheard of for accounts to be summarily closed without warning. While many people who report such closures claim they’re completely innocent, I have a feeling most of them have done something to get on the radar of the credit card companies. Chase seems particularly ruthless toward program abusers. There is even a huge Flyertalk thread just for reports of Chase Ultimate Rewards accounts being wiped.

While most of these cases are probably warranted, I’m sure mistakes are sometimes made and unsuspecting decent folks have their points accounts obliterated without just cause. The fine print associated with these programs usually gives the bank total authority over your points accounts.

Even if you’re not playing with fire, the chance exists that you could fall out of disfavor with a bank or airline and lose all your stockpiled miles. Don’t take the chance . . . DON’T HOARD POINTS!