Around the time of Nicoleen’s and my anniversary trip to Europe this summer, valuetactics.com got quite a lot of attention from Nicoleen’s facebook crowd. Many friends and relatives asked Nicoleen or me how we landed such good deals on the flights, hotel, and other trip expenses. If you want more detailed on the trip itself, check out this post outlining our itinerary.

If you’re one of those who are just curious how we did it (and maybe are curious how you too can travel for free!) in this post I’ll briefly outline the strategy we use to accumulate points and plan trips.

If you’re just starting out it’s helpful to adopt one of two strategies, to avoid accumulating what may turn out to be less than useful points.

Points and miles strategy #1: Goal first, then reverse.

If you have enough lead time, you can start with your desired travel plans and then work backwards to figure out which points and miles programs would be most useful to you, and which cards/offers are best at earning you those points or miles.

Here’s a hypothetical example to illustrate the thought process:

- You and your spouse want to go to Park City, Utah, for a weekend skiing get-away in March. Your travel budget only covers lift tickets, dining, and bar tabs; so your airfare and lodging need to be free. You’re also very demanding about accommodations so you need to stay in a luxury resort.

- You regularly read valuetactics.com, so you know the best way to get free luxury hotel stays with a few month’s notice is with either the Hilton HHonors Reserve card from Citi or the Hyatt card from Chase. Both cards offer 2 free nights as the sign-up bonus, but the Hilton free nights are only good on weekends – not a problem for your plans. (Others, like Chase’s IHG card, only offer free nights as an account anniversary award). If you and your spouse each get approved for your own cards, you have 4 free nights to redeem…more than sufficient for your weekend ski trip.

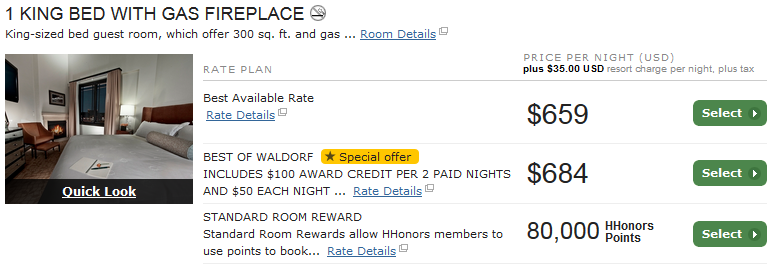

- You check availability for March 18-21 at Hilton’s luxury resort in Park City, the Waldorf Astoria, and Hyatt’s, The Escala Lodge at Park City. Unfortunately, (for the sake of the example) you find that the Hyatt has no rooms available for reward certificate redemption. You check the Hilton website…your heart is pounding…will there be free rooms available? …yes! The Waldorf Astoria has plenty of reward certificate availability for that weekend! Looks like you’ll be applying for that Citi Hilton HHonors Reserve card.

The nice round number for the room’s award points price tells you it’s Hilton’s “standard” rate, meaning it’s available for a free night certificate redemption. A $659/night room for free…not a bad deal for taking a few minutes to apply for a card and make sure you hit the bonus spending!

The Waldorf Astoria in Park City, Utah

-

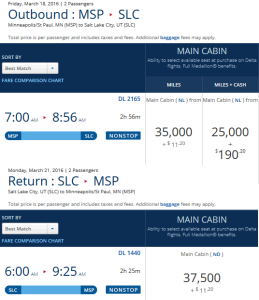

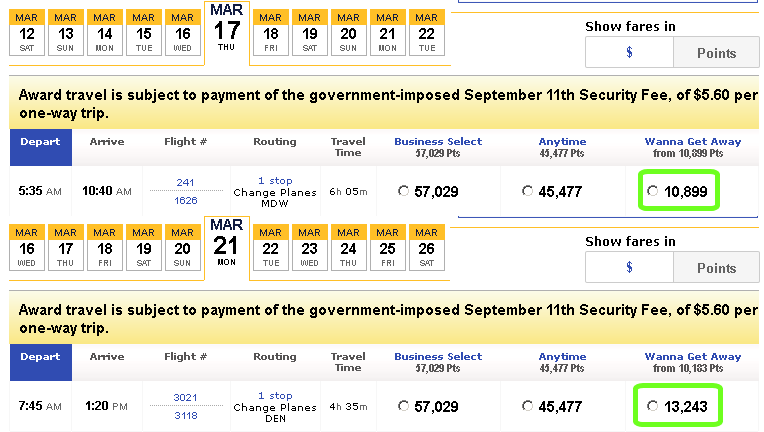

Ok, you have lodging covered. Now on to the free airfare. One of the keys to redeeming miles for flights is to find the “saver” level award availability. This is the discounted rate and will allow you to maximize the value of your airline miles. You can safely assume that at a given moment you have at least 2-3 options for cards that will earn you 40-50k airline miles or points that can be transferred to airline miles. So for this example, we’re trying to get two flights on our desired dates (March 18-21, 2016) for under 50,000 miles.

Let’s start with Minneapolis’s home town hero, Delta:

72.5k miles each; 135k miles for both of you…unacceptable.On to United:

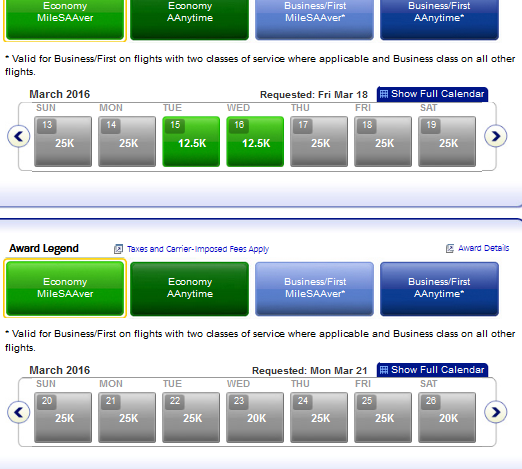

No saver level seats available for your dates.How about American?

No dice.Southwest?

Now we’re talking!

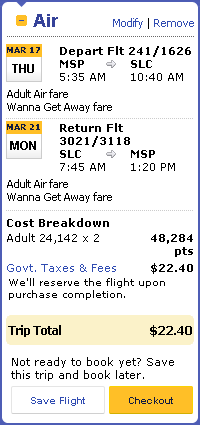

Two round trip flights for under 50k miles. - So how do you get 48,284 Southwest miles? Chase routinely (2x per year on average) jacks the sign-up bonus on their Southwest card up to 50,000 points. For this example, let’s say the 50k promotion just ended and the card comes with the standard 30k bonus. If you think you can get the bonus and quickly put another $18,284 in spending on the card to get the remaining points needed for your flights, then get the card! But remember, seat availability for flights is constantly changing so you probably want to get your seats booked ASAP, so trying to earn the remainder of the points organically might take a few months and your seats may be gone by then. Alternatively, you could each get the card and you’d be set, but I personally would never apply for a card that regularly has a jacked up bonus unless that promotion is running.

- Is there a more streamline way to get 50k Southwest points fast? Why yes there is! Southwest happens to be a transfer partner of Chase Ultimate Rewards, meaning you can transfer UR points to your Southwest Rapid Rewards account at a 1:1 ratio, for free, instantly. There are several cards that earn Chase Ultimate Rewards including Chase Freedom, Sapphire Preferred, and Ink Plus business. After looking at all the benefits of these cards, you decide on the Sapphire preferred because the annual fee is waived the first year and it will earn you 49,000 UR points after meeting the bonus spend of $4k in 3 months. How convenient…that’s just what you need to transfer to Southwest and get your flights for free!

Let’s recap this example:

For applying for 3 credit cards between the two of you, paying the $95 annual fee on the two Hilton cards, and paying the $22.40 in fees to the airline, you are getting:

- $2,082 worth of lodging to stay at the Waldorf Astoria for three nights

- $809.92 worth of airfare on Southwest for two round trip tickets to SLC

- That’s a total of $2892 in travel expenses for paying $202, doing some research, and spending 15 minutes to apply for a couple cards. A pretty good value if you ask me!

Points and miles strategy #2: Go all in!

If you don’t have a specific goal in mind, or would like the most flexibility when planning free travel, you could go all in and start accumulating as many points and miles as you can. This also means diversifying. Concentrating on highly versatile points is one facet of this strategy. Earning points in several different competing programs is another.

This strategy can be as valuable as you want it to be. The more carefully you plan and the more variables you look at, the more you can maximize your card applications. It would take a whole book to look at every facet of this strategy, but I will try to get you to think about some things to consider when getting into this game for the long haul.

- Which cards can you “churn,” getting the bonus multiple times?

- What is each card/bank’s particular quirks when considering applications?

- What is your current credit score?

- Which cards earn what kind of points?

- Which points can transfer to which other programs?

- Are there currently any “jacked up bonus” promotions running?

- Do you have any travel plans on the horizon, a la strategy #1?

- How can you group applications to maximize all of the above?

- Other than the points bonus, what other benefits does each card have?

- Can you stretch the benefits of a card by staggering them with your spouse?

- Are there any weak points in your points and miles portfolios?

- Which cards will soon be phased out?

As you can see, there is a lot of thought that can go into this game if you really want to maximize the value. Use this site and others to learn all you can about the different programs. I promise you, the learning curve is steep but short, and 90% of the confusion will go away by the time you earn your first card bonus and book your first trip with miles and points. If you have already been taking advantage of frequent flyer programs or hotel loyalty programs, you already have an advantage.

I recommend liking the ValueTactics facebook page and following the twitter feed to stay updated on these tactics and strategies! I’m also always willing to help if you contact me privately.

A Hybrid Strategy

Of course you are not bound to one of these two strategies. Realistically everyone should incorporate elements of both into their planning, regardless of how much thought you put into that planning.

I hope this little primer helped some of you understand what to think about when deciding which card(s) to apply for. Now get out there and capture some value!