One of the goals of Valuetactics.com is to prove that these tactics are worthwhile. To do that, I provide monthly reports of our points, miles and savings activity. I also try to provide semi-monthly updates as a way of showing the typical level of valuetactical activity in our household.

My wife and I don’t do manufactured spending. We don’t do extreme couponing. We don’t apply for new credit cards as often as humanly possible. We simply put all our spending on credit cards, strategically apply for good card offers, and make use of other miscellaneous savings tactics. I think my monthly totals updates are a good representation of what a normal couple could expect, if they take advantage of the tactics on this site.

2016 Totals

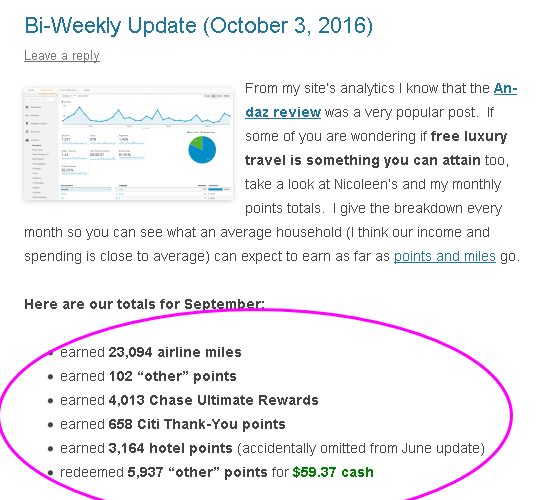

Just like my monthly totals, here is our household annual points and miles activity. (I count redemptions in 2016 if I booked the tickets in 2016, even if the trip will be in 2017.)

Earning

- earned 90,025 airline miles

- earned 202,452 hotel points

- earned 91,473 Chase Ultimate Rewards

- earned 97,093 Citi Thank-You points

- earned 64,308 “other” points

Transferring

- transferred 84,000 Ultimate Rewards to airline and hotel programs

- transferred 25,000 Citi Thank-You points to an airline program

Redeeming

- redeemed 35,000 airline miles (+ 83,046 transferred from Chase UR and Citi TY)

- redeemed 95,000 hotel points (+ 5,000 transferred from Chase UR)

- redeemed 40,728 Citi Thank-You points

- redeemed 66,226 “other” points

Total value from redemptions booked in 2016: $15,495.90

Total credit card interest (and annual fees) paid in 2016: $1,149.24

Total interest saved with 0% promotions: $290.90

Free gas tactic savings: $252.45 (a 17.98% overall discount)

Net value for all our efforts: $14,890 !!

You can do it!

I show these results not to brag, but to motivate you to capture some value of your own! Here are some of my favorite articles to guide you:

– Which Card Should I Get?

– Are you too disorganized for this stuff? NO!

– Tracking is the Key (and why you shouldn’t do it)

– 3 Years of Collecting Points Could be Worth $77k

– Chase Ultimate Rewards: Versatility Matters!

– Don’t Hoard Points!

– Zeroth World Problems

If you contact me privately, I can walk you through some ideas for which credit cards to get to meet your goals.

And of course you should like the ValueTactics facebook page and join the discussions there!

Here’s to a valuable 2017!