The Marriott Rewards card from Chase can be a very valuable addition to your hotel points portfolio. It comes with a lucrative 80,000 point sign-up bonus and it has some lasting perks that might make it worth keeping in your wallet.

Basic Stats

- Issuer: Chase

- Logo: Visa Signature

- Points earned: Marriott Rewards

- 1 point per dollar on all purchases

- 2 points per dollar on airline tickets, car rental, and dining

- 5 points per dollar on purchases at Marriott

- Annual fee: $85 (NOT waived the first year)

Current Sign-up bonus

80,000 Marriott Rewards points after $3000 spend in 3 months. You also get 7,500 points for adding an authorized user and making one purchase with that card.

However, there are several variations available through public offer pages, according to the Flyertalk wiki on the Chase Marriott Rewards card. We’ll discuss whether one of these variant sign-up bonuses might be a better value for you below. Unless otherwise noted, this review will assume we’re talking about the “standard” bonus. This is the bonus I got on the card, and the same bonus you can get by applying through my referral link.

Adapted from the Flyertalk wiki:

There are currently 3 noteworthy offers. They all have $3k minimum spend in 3 months and do NOT include a one-night category 1-4 certificate the first year, but they do include a category 1-5 certificate in subsequent years:

- 80k + 7.5k AU, AF not waived first year.

- 40k + $200 credit for first purchase + 5k AU, AF waived first year.

- Two initial cat 1-5 certs + $200 credit (both contingent on $3k spend/3mos) + 7.5K AU, AF waived first year

Sign-up Bonus and Annual Free Night

The 80,000 point sign-up bonus is the main reason the Chase Marriott Rewards Premier card is worth considering. It’s a difficult task to assign values to hotel points, due to the vast differences in redemption options. That being said, I use 0.85 cents per Marriott point as a rule of thumb. Using this valuation, if a 10,000 point award night would cost more than $85 cash (don’t forget to include taxes!), you’re getting a good value with your points.

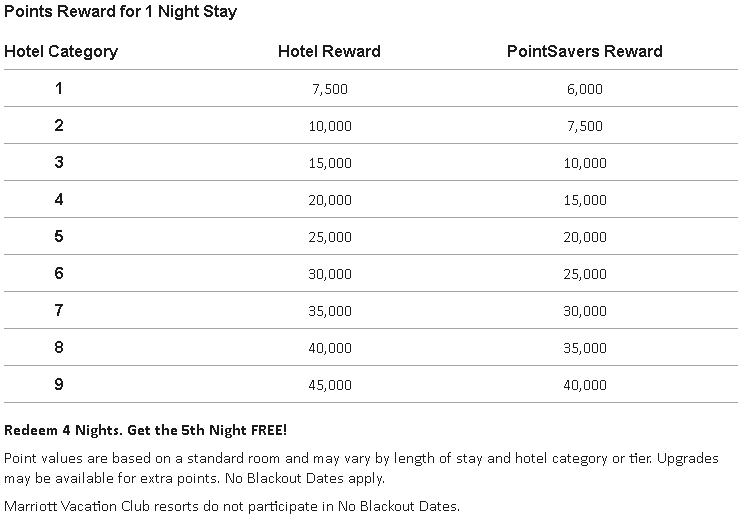

Here’s the current Marriott Reward redemption chart:

If you add an authorized user you’re up to 87,500. And by making the minimum spend of $3k to get the bonus, you’ll have at least 90,500, not including any category spending bonuses. As you can see, you could stretch 90,500 points a long way!

If you add an authorized user you’re up to 87,500. And by making the minimum spend of $3k to get the bonus, you’ll have at least 90,500, not including any category spending bonuses. As you can see, you could stretch 90,500 points a long way!

Redemption Example #1

11 nights in February at the AC Hotel in Guadalajara, Mexico

It’s a Category 2 property, so 10,000 points per night. 90,500 points is enough for 9 nights, but every consecutive 4 award nights booked with Marriott gets you a 5th free night. That makes 11 nights in this example. The cash value (with tax) for the same room is $109.48/night, for a total value of $1204.28!

Redemption Example #2

5 nights in October at the Courtyard Orlando at Vista Center, Florida

This Category 4 property is 20,000 points per night. 80,000 points gets you 4 nights and the 5th night is free. The cash value for the same stay is $587.25.

Redemption Example #3

2 nights in July at Domes Noruz Chania, Autograph Collection, Crete

I went all out when looking at this amazing Category 9 resort on Crete. With the Chase Marriott Rewards card your 90,000 points will get you two nights at this paradise. A cash value of $777.12. (exchange rate as of this writing)

Click here to apply for the Marriott Rewards premier card from Chase

Do some example searches on www.awardmapper.com or look up hotels by category at the Marriott website to see what this card is worth to you!

Keep or cancel? After one year of card membership, the second year’s annual fee will be due. The anniversary night bonus is good for any Category 1-5 property. With a few quick searches it’s pretty easy to see how you could get more value than the $85 annual fee would cost you. Of course if you have no use for a free night stay at a Marriott property in the upcoming year, the annual fee might not be worth it for you. If you already spend a number of paid nights at Marriott properties throughout the year, the 5x category spend bonus will add to the value of keeping this card for more than the first year.

My experience with the Chase Marriott Rewards Premier

In a recent update post I promised to include the total value I personally gained from each of the cards I review. This post proves me a liar! I have over 90,000 Marriott points from this card’s bonus and a bit of spending, but I haven’t redeemed them yet. For a hint on how I plan to redeem these points, look at my example redemption #2 above. It will be something very similar. And if you happen to know my kids, KEEP YER MOUTH SHUT! 🙂 (They don’t know yet!)

Should you get this card?

Yes, but with caveats. It should be pretty evident to you by now that the up-front $85 annual fee is nothing compared to the potential value of this card’s benefits. I would recommend the Chase Marriott Rewards card to anyone as long as they can find a way to use the bonus points. This is even easier to do now that Marriott and Starwood are currently undergoing a merger. You can use Marriott Rewards at a 3:1 ratio to redeem for Starwood award nights from now until the merger is complete.

However, because of the Chase 5/24 rule, when (and if) you get this card matters. For example, if you’ve already been approved for 4 new credit card accounts in the past 24 months, the 5/24 rule says you can currently only get one Chase card. If you don’t already have one of the more valuable cards from Chase, like the Sapphire Preferred or Sapphire Reserve, skip the Marriott card for now.

Which sign-up offer should I take?

Near the top of this post, I listed several alternative sign-up offers currently available. Links to these offers can by found on the Flyertalk wiki page. The top offer is identical to the one described in this post, and for which I have a referral link (click below!).

Which offer is right for you is a matter of simple math. Calculate the value you think you will get for the bonus offerings, and take into account whether or not the annual fee is waived for the first year. The only way to calculate this is to do some sample hotel searches. I went with the 80k point bonus with the annual fee not waived the first year. If you want to apply for the same offer and support your favorite website, ValueTactics.com, at the same time, please use my link to apply! 🙂

Click here to apply for the Marriott Rewards Premier card from Chase