The Chase Hyatt card is a giant among hotel cards. A look at online reports of where people have used the free night certificates earned with this card could inspire just about anyone to take up the credit card hobby. After spending $2000 in the first three months, you will get two certificates good for a free stay at any Hyatt in the world. There’s also an annual free night bonus good at any Hyatt, category 1-4, for paying the $75 annual fee. Regular spending on the card earns Hyatt points, which can easily be redeemed for over $0.025 per point.

Basic Stats

- Issuer: Chase

- Logo: Visa Signature

- Points earned: World of Hyatt (formerly called Hyatt Gold Passport)

- 1 point per dollar on all purchases

- 2 points per dollar on airline tickets, car rental, and dining

- 3 points per dollar on purchases at Hyatt

- Annual fee: $75

Sign-up Bonus and Annual Free Night

Like most credit cards, the majority of the Hyatt card’s value is in the sign-up bonus. After spending $2000 within the first 3 months with this card, you get 2 free night certificates for any Hyatt in the world. Depending on how you use the free nights, this bonus can be incredibly valuable! (Like $3000+ valuable – read on . . .)

Getting an authorized user card within the first 3 months and making one purchase with that card will also earn you 5,000 bonus points.

The free night certificates are good for 12 months from the date they are issued. Unlike many sign-up bonuses, these will appear in your Hyatt account a few days after the minimum spend is met. You don’t have to wait until the statement closes.

Hyatt properties are classified in categories 1-7 and there’s no category limit on the free night certificates. This means there is enormous potential value with these certificate redemptions. But, it also means you can really miss out on a lot of value by not doing your homework.

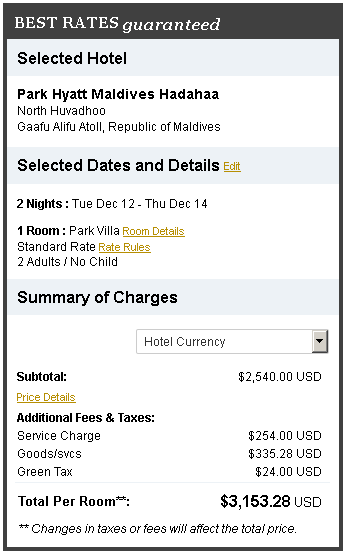

For example, you could use the certificates on a $225 two-night stay at the Hyatt Place in Milwaukee in October (LOW VALUE WARNING). Or, you could use them on this:

. . . a $3,153 two-night stay at Park Hyatt Maldives Hadahaa. As you can see, this card’s value can drastically vary, depending on how you plan your certificate redemptions.

My experience with the Chase Hyatt card

I have known about the potential value of the Chase Hyatt card since my earliest days of playing the credit card game. I put off getting the card until I had a good plan for using the free nights. My plan all along was to get the card at the same time as my wife so we would have 4 free nights total. Four free nights would make a nice vacation but 6 would be even better, so I wanted to get another card that came with free hotel stays, the Citi Hilton Reserve, at the same time.

Everything lined up nicely in November 2015. Nicoleen and I both got the Chase Hyatt card and she got the Citi Hilton Reserve at the same time. This was the set-up I had strategized in order to plan a whole vacation with the free nights from these cards.

Everything lined up nicely in November 2015. Nicoleen and I both got the Chase Hyatt card and she got the Citi Hilton Reserve at the same time. This was the set-up I had strategized in order to plan a whole vacation with the free nights from these cards.

There was a promotional deal when we applied for this card. The annual fee was waived for the first year and there was a $50 statement credit after making the first purchase on the card. The bonus spend was also lower than the current requirement of $2000. We only needed to spend $1000 in the first three months to get the free night certificates.

(Read more about our round of card applications here.)

How we used the free nights

After some thorough planning, we used our combined four free nights at the Andaz Maui at Wailea. The cash value of our 4-night stay was $2,158.24. You can read my full review of this amazing property here.

How we used the free anniversary night

When it came time to pay the annual fee on the Hyatt card, we had to decide whether to cancel it or pay the $75 fee and get the anniversary night. We didn’t have any firm plans to use the Hyatt category 1-4 free night, but we were sure we could find something that would be worth the $75 annual fee.

I ended up throwing together a long weekend trip to Costa Rica, to stay at the wonderful Andaz Peninsula Papagayo. We used both our anniversary nights and paid for another night with points. For the full report of this trip, click here.

The bottom line – total value of the Chase Hyatt card

Since Nicoleen and I both got this card and used the benefits together, I calculated the value of the card by totaling everything and dividing by 2. Keep in mind this is the value I received from the card. It should not by used as an absolute value for the card. Your mileage may and will vary.

- Sign-up bonus: 4 nights at Andaz Maui: $2,158.24 – $106.40 for mandatory valet parking = $2,051.84

- Anniversary night: 2 nights at Andaz Peninsula Papagayo: $994.40 – $150 for annual fees = $844.40

- Points redemption: 15,000 points for 1 night at Andaz Peninsula Papagayo: $546.92

Between the two cards we earned 19,883 Hyatt points. Using our one redemption as a model, the points are worth $0.0365 each, so 19,883 points is worth $724.96.

(2,051.84 + 844.40 + 724.96) / 2 = $1,810.60

In our specific case, the value we reaped from each of our Chase Hyatt cards is $1,810.60 each!

The sign-up bonus alone (not counting any points earned) was worth $1,025.92 per card.

Should you get this card?

IMPORTANT: Because of the Chase 5/24 rule, when you get this card matters. Chase summarily declines any credit card application if the applicant has opened 5+ cards from any bank in the past 24 months. Therefore, carefully place your application for the Chase Hyatt card into your overall credit card strategy.

If you ever stay at hotels for any reason

YES. Even if it’s for your great great grandma’s out-of-town funeral or your cousin’s hairdresser’s kid’s graduation party 4 hours away, most of you find SOME reason to stay in a hotel once or twice in a year. The Hyatt portfolio of hotels is pretty extensive, especially in large cities. You would be hard pressed to not make your annual fee back by staying two nights free at even the cheapest Hyatt properties.

If you aspire to free travel greatness

YES. This should definitely be one of the key cards in any value tactician’s strategy. BUT, I highly recommend having a good plan in place before you apply for it. If there are two of you and you can both apply, all the better. Just take a second look at my experience with this card to see why.

If you somehow never plan on staying in a hotel, ever

NO. All of the Chase Hyatt card’s benefits apply to hotel stays.

As always, feel free to contact me privately or on the ValueTactics Facebook page for personalized advice or discussion on any credit card or points related topics!