In recognition of the art of last minute shopping, this update features some miscellaneous value tactics you can take advantage of around town. When you read the following tactics, keep in mind one of the principles from the strategy page: If you have to make a purchase to get something for free, it’s only really free if you were going to make the purchase anyway.

Everyone loves free chicken!

If you’re near a Raising Cane’s restaurant you can get a free meal by signing up for their Caniac Club. You need to register the card and verify your e-mail address. The free box combo meal will be loaded onto your account within 48 hours. (For detail weirdos like me, here’s the official rules). To get the free meal you have to opt in to receive e-mail promotions. Like all of these deals, it’s easy to remove yourself from the e-mail list once you have received your free stuff.

Each family member with a unique e-mail address can get their own free chicken meal. Thanks to ValueTactics reader Alex for the tactical reconnaissance!

Everyone loves free pop!

Expires 12/24 – At Holiday gas stations you can get a free 12-pack of pop when you buy $50 worth of gift cards. You can choose any Coke or Pepsi product. As some of you know, I am usually loyal to Super America stations because of their rewards points program. With free gas tactics I have saved over $1000 in the past 3 years at Super America. But with the loss of double coupon Tuesdays my loyalty is waning. I’m going to spend $50 on gas anyway. And 12-packs are $3.50-5.00 nowadays, so this is a good deal to me.

Everyone loves free gift cards!

Many restaurants run free gift card promotions during the holiday season. The deal is usually something like this: “Get a free $5 gift card with the purchase of a $20 gift card!” The dollar amounts and the terms vary from restaurant to restaurant and year to year. I have seen these at Taco Bell, Leeann Chin, and Raising Cane’s. There are a lot more of these deals out there, and I’m sure a quick google search will bring up dozens of super spammy, pop-up riddled “deals” blogs that have complete listings. A fairly up-to-date one I just discovered is here.

Some restaurants will let you use the free bonus gift card right away. Others, like Leeann Chin last year, wouldn’t let you use the bonus card on the same visit. Does it count if you walk out the door and go back in? Someone didn’t think out these rules very well.

The nice thing about these deals is they are an automatic double dip. With a $5 bonus GC when you buy a $25 GC, you’re basically building in a 20% discount to anything you eventually buy with the card. Since the bonus card is just another payment method, you still get whatever deals or coupons you would regularly use when you’re using these to pay.

New ValueTactics Blog Posts

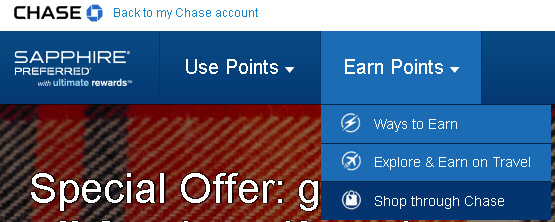

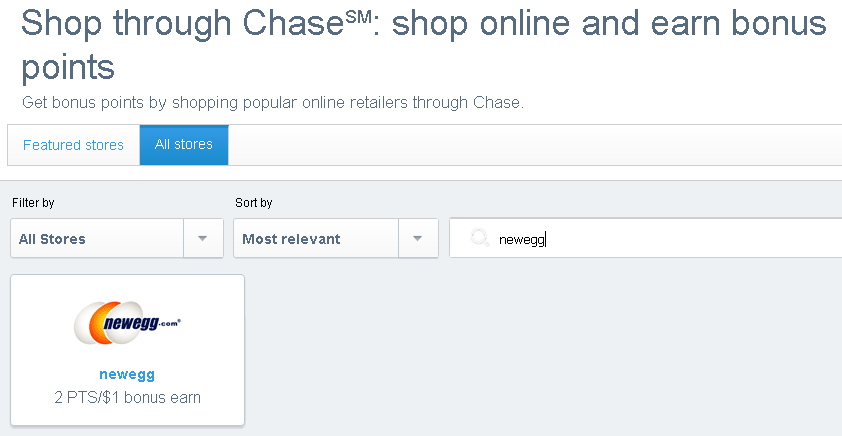

– Online Shopping: How to Avoid My Biggest Mistake this Holiday Season explains how you should be getting bonus points or miles on nearly all your online shopping purchases. It’s easy, it’s quick, and I still forget to do it sometimes. Don’t be like me; read the article and get the free points!

Travel Update

Nicoleen and I leave in 50 days for our Costa Rica trip! I mentioned this trip in the last semi-monthly update. It will be almost fully paid for with points and miles. It was the quickest and easiest free trip we’ve planned. We are excited!

Now you’re updated. Go employ some Value Tactics!

Map generated by ValueTactics using the Great Circle Mapper – copyright © Karl L. Swartz.

There is still time to get the

There is still time to get the