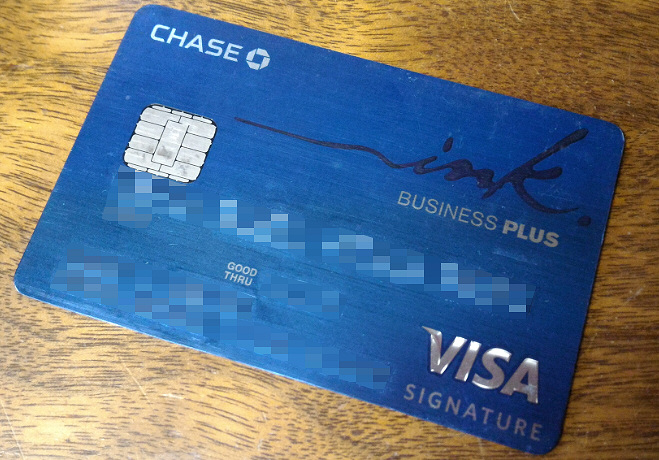

UPDATE: This card has been replaced with the Ink Business Preferred.

The Ink Plus is Chase’s Ultimate Rewards earning business credit card. With a new standard sign-up bonus of 60,000 Ultimate Rewards points, this card is a heavy hitter in terms of value potential. And the value of the Ink Plus doesn’t all lie in the sign-up bonus either; it has generous 5x and 2x category bonuses as well, making this card one you may want to keep in your wallet for the long haul.

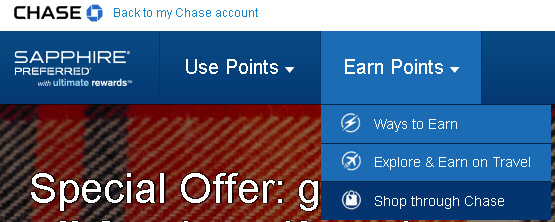

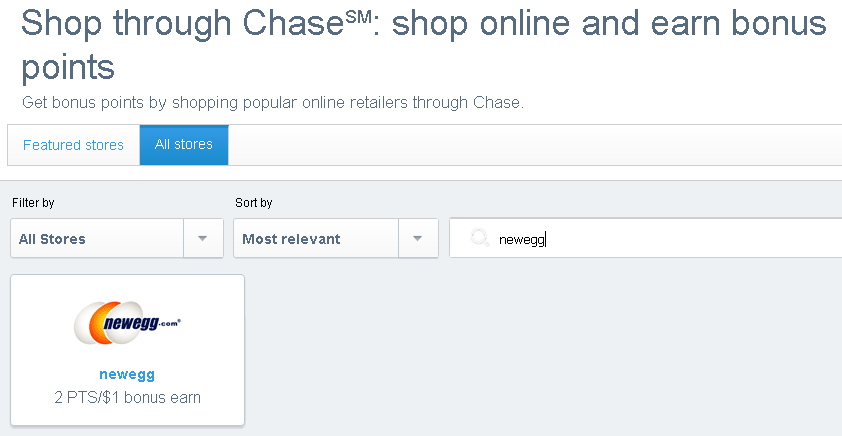

Basic Stats

– Issuer: Chase

– Logo: Visa Signature

– Points earned: Ultimate Rewards

– 1 pt per dollar on all purchases

– 2 pts per dollar on gas and lodging

– 5 pts per dollar on phone/internet/cable, and at office supply stores

– No foreign transaction fee

– Annual fee: $95 (NOT waived the first year)

Current sign-up bonus

60,000 bonus points after $5000 spend in 3 months

In 2014 I flew to Europe and back for 60,000 United miles, transferred from Ultimate Rewards. The bonus alone on the Ink Plus could get you the same flights!

A giant sequoia at Insel Mainau gardens in Konstanz, Germany

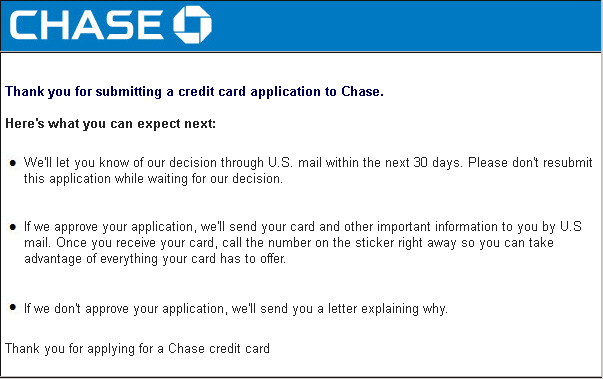

Click here to apply for the Ink Plus business card from Chase

This card has been replaced with the Ink Business Preferred.

Can I get a business card?

This question probably scares away a lot of potential card holders of this and many other business cards with lucrative sign-up bonuses. Lucky for most of you reading this, we live in the USA, where having a “business” can mean many different things. Basically any side income that you earn that doesn’t show up on a W-2 can count as a business for the purpose of applying for a business credit card.

I have heard of many examples of businesses used to apply for these cards, some more legitimate than others. I have done ceramic tile and stone installation for over 10 years and even though it’s now an form of infrequent weekend income, it definitely qualifies. I have expenses and I earn income; that’s basically all that’s required. Others I have heard of include: bicycle racing expenses and winnings, online sales (amazon and ebay), running a website, and even inconsistent odd jobs. All of these could qualify you for a business card.

When applying, my advice is to embellish where needed, but never outright lie. If you are just starting a business or online sales effort you can use projected or expected income on your application. Be optimistic about your income figures and don’t skimp when you’re asked how much you expect to put on the card. When it comes down to it, unless you have a thriving business with employees, the bank will probably base most of its decision on your personal income and credit score (if you don’t have a federal tax ID, you will use your personal SSN for the application.)

Sign-up and category bonuses

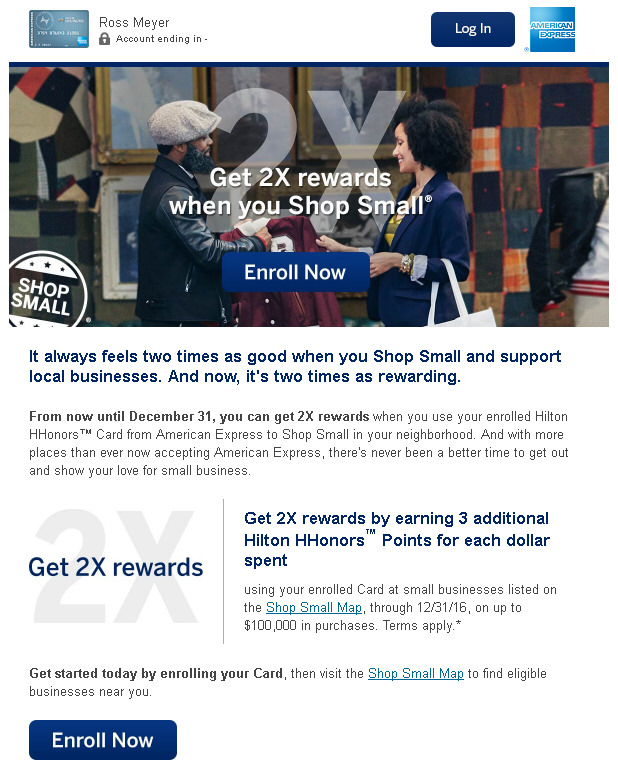

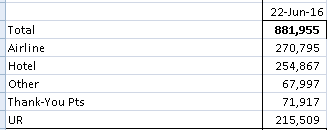

The 60,000 Ultimate Reward bonus is incredible! Even considering you pay the first year’s annual fee up front, this card’s sign-up bonus is more valuable than its non-business counterpart, the Chase Sapphire Preferred. After the initial spend of $5k, you’ll have at least 65,000 UR points. That’s enough for:

. . . And that’s just the minimum points you’ll have after meeting the $5k spend. If you have $250 in monthly cell phone and landline/cable/internet bills on this card, you’ll earn 1250 UR points a month, or 15,000 a year. That doesn’t even consider other spending you may put on the card, including the 2x point earning on gas station purchases and lodging.

My experience with the Ink Plus

When I got the card it had an elevated sign-up bonus of 70,000 points. This deal has been seen before (and even higher, but with higher minimum spends) but the 60,000 UR bonus is one of the best around, so I wouldn’t wait for an elevated bonus. I just had lucky timing.

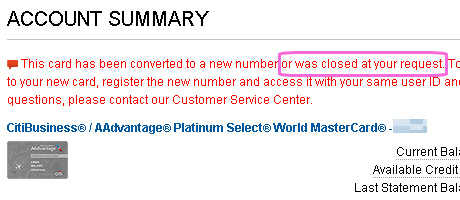

I have had my Ink Plus for over a year. I calculated the 5x category bonus on our cellphone and internet bills just about paid for the annual fee. So additional value I get from having the card is basically free. I also use this card on business expenses (tile supplies purchased for clients) and some fuel purchases. For me the category bonuses might make this card more of a keeper than the Sapphire Preferred. I will have to make that decision soon, as my Sapphire Preferred annual fee is due soon. (Always remember to transfer your UR points to another UR account in your household before you cancel an UR-earning card!)

Should you get this card?

Yes! The total value from getting this card is easily over $2000 and can be much higher if you redeem your transferred miles tactically. If you have absolutely no travel plans in your future, the card is still worth at least $650 in the cash-out value of your points, all for a $95 annual fee. That’s $555 profit just for getting one card and making sure you meet the minimum spend. (Don’t redeem for cash though . . . the UR points are worth much more when transferred to a partner program!)

Here are some things to consider when working the Ink Plus into your overall card strategy:

- IMPORTANT: You have to prioritize applications for Chase cards because of the 5/24 rule.

- Ultimate Rewards points are very versatile so having a stock of them early in your value tactics career would be helpful.

- The 60,000 UR sign up bonus is worth more than the 50,000 point bonus on the Sapphire Preferred personal card, even when accounting for the up-front $95 fee.

- The $5000 spending requirement may be a challenge for you to meet, especially if you have other bonus spends cooking at the same time. (REMEMBER, the $95 annual fee does not count toward your bonus spend.)

The Chase Ink Plus is an amazing card for it’s category bonuses, fringe benefits, and extremely valuable sign-up bonus. If you can make the case that you have a business (not very difficult – see above), I would highly recommend that you get this card early in your points career!

Click here to apply for the Ink Plus business card from Chase

This card has been replaced with the Ink Business Preferred.