On tap for this update: status of my current bonus spending, a ValueTactics format change, our personal April totals, new blog post review, and updated travel plans.

Our Bonus Spending Progress

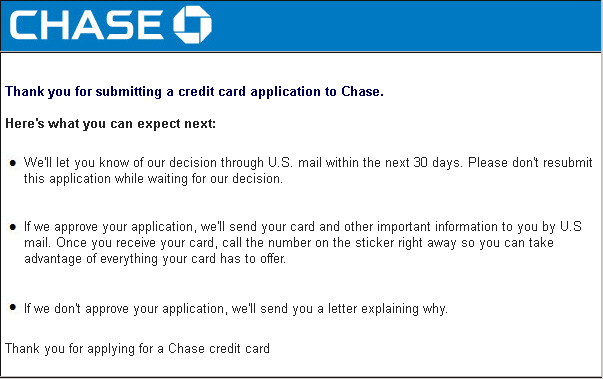

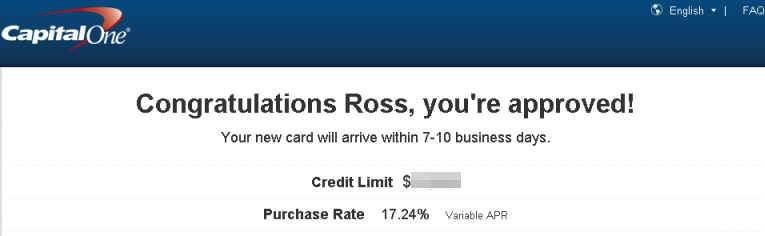

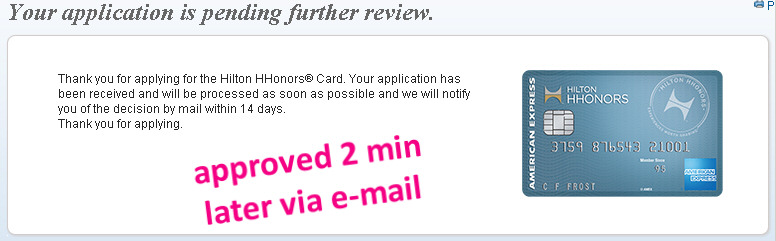

In April we got three new cards. We have completed the $1k spend on the Amex Hilton HHonors card, thereby earning the 75,000 point bonus. We are still working on the $3k spend requirement for the 80,000 point bonus on the Chase Marriott Rewards Premier card. We’re also still working on the hefty $4.5k spend requirement for the $400 cash bonus on the Capital One Spark Cash for Business card.

New ValueTactics Blog Posts

– Barclay Announces Website “Improvements” is my rant about the prominent form of website design being used today. If you’ve logged into a credit card online account in the last year, you’ll know what I’m talking about.

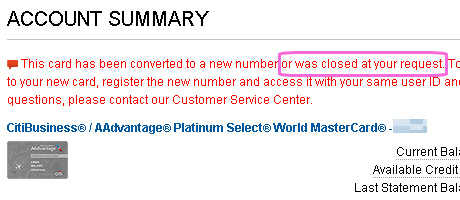

– A New Way to Cancel Credit Cards described my experience cancelling a card online. It’s an effective way to avoid the song and dance with the customer service rep when you know for certain all you want to do is close the account.

Website News

Any regular reader of this site knows that I’m not the best at getting my regular weekly updates posted in a timely fashion. This site is purely a hobby for me and my day job and family commitments have to come first. Many times I go two weeks or more without a publishing a single post. To put the expectation more in line with reality, I am turning “weekly update” into “bi-weekly update.” It’s my hope that this realistic target will help me to update the site more frequently by preventing the writers’ block that occurs when one falls behind schedule.

Travel News

We are now less than a month away from our family vacation to the Black Hills of South Dakota! We are using IHG points for a hotel room in Rapid City and we’ll be camping for the following few days. You can bet we’ll be racking up My SA Rewards points toward free gas along the way!

Household April Totals

In April I saved $8.29 in gas commuting to work using free gas tactics. Between Nicoleen and I, here’s what we earned for points:

- earned 229 airline miles

- 9 “other” points expired ($0.09 worth of ‘orphan’ points)

- earned 443 Citi Thank-You points

- earned 1,706 Chase Ultimate Rewards

Now you’re updated. Go employ some Value Tactics!