In September of 2016, Nicoleen and I embarked on our long-awaited Hawaiian get-away. This 7-night luxury trip to Maui was our first time to Hawaii, and knocked off one item in my bucket list. It took some advanced tactical planning to get the flights and all the hotel stays to align properly. Read on to find out how we planned and executed our much needed Hawaiian get-away and got $4,152 worth of lodging and airfare for $189 by tactically redeeming miles and free nights!

[Mostly] Free Hotels

After our involved and arduous planning phase, we accomplished our goal of 6 free nights at luxury resorts. Since our flight didn’t arrive in Maui until late evening, we wanted to burn our first night at an inexpensive hotel near the airport. That way we would get to enjoy our whole first day at the Andaz.

With a little help from Tripadvisor reviews (always part of my research) we settled on Maui Seaside Hotel in Kahului. I had an e-mail offer from Rocketmiles for 4,000 bonus miles with my first booking. The price for the room was only $11 more through the Rocketmiles price search. Since I value 5,000 American Airlines miles at far higher than the $11 difference, the offer was well worth it.

– Click for my full review of the Maui Seaside Hotel –

– Click for my full review of the Maui Seaside Hotel –

After the brief stay in Kahuilui it was on to the incredibly upscale southwest Maui town of Wailea. There we stayed at the two resorts that our whole trip revolved around. The first was the Andaz Maui at Wailea. The second was the Grand Wailea, a Waldorf Astoria Resort.

– Click for my full review of the Andaz Maui at Wailea –

– Click for my full review of the Andaz Maui at Wailea –

– Click for my full review of the Grand Wailea, a Waldorf Astoria Resort –

– Click for my full review of the Grand Wailea, a Waldorf Astoria Resort –

Our hotel schedule looked like this:

Cost Summary

* Add the $95 annual fee on the Citi Hilton Reserve to our lodging cost, if you want to count that.

Points earned on the trip were 4,993 Hyatt points, 4,693 Hilton points, 4,179 American Airlines miles, and approximately 1,500 Chase Ultimate Rewards.

Origin of Concept

I had known about the Chase Hyatt card and the Citi Hilton Reserve card from my early days of credit cards, points and miles. These are very popular cards because of their sign-up bonuses: both cards offer two free nights at any category of property from their respective portfolios. Obviously the value potential when redeeming these free nights is enormous. Each card could conceivably be used for $1000+/night resorts. I briefly discussed the possibilities for these free nights in this post when we first got these cards.

Between two people you’ll have a total of 8 free nights if each of you gets both cards. It’s a little tricky though, because the Hilton free nights are only good on weekends (Fri, Sat, Sun nights). So in order to get 8 nights in a row, you’d have to split your stay at the Hilton in two, with the 4 Hyatt nights in between. We had no interest in switching hotels twice, so our goal was 6 nights split between 4 Hyatt nights and 2 Hilton nights. (We had to do this anyway since I had already used both free nights from my Hilton card on previous trips).

Between two people you’ll have a total of 8 free nights if each of you gets both cards. It’s a little tricky though, because the Hilton free nights are only good on weekends (Fri, Sat, Sun nights). So in order to get 8 nights in a row, you’d have to split your stay at the Hilton in two, with the 4 Hyatt nights in between. We had no interest in switching hotels twice, so our goal was 6 nights split between 4 Hyatt nights and 2 Hilton nights. (We had to do this anyway since I had already used both free nights from my Hilton card on previous trips).

The trick then became finding two amazing properties close to each other, one Hilton and one Hyatt. . .

The Planning Phase

As you may have guessed from the post I referenced above, I had already given some thought to which pair of Hilton and Hyatt properties I was aiming for. There are a number of fantastic locations around the globe with worthwhile resorts from each chain near to each other. But I had my heart set on Hawaii; specifically the Andaz Maui from Hyatt and the Grand Wailea from Hilton’s Waldorf Astoria collection.

The logistics of this trip were quite a tangled mess to sort out . . . but it was possible with enough research and advanced planning!

This trip was a real doozie to plan! I had to coordinate 2 free hotel stays at highly in-demand properties. The dates had to fit with our work schedules. We needed to be reasonably certain we could arrange child care for the dates. Plus, the hotel dates needed to mesh with available flights we could purchase with miles.

Here’s how my thought process worked as I approached this monumental task:

- Time window. We got the card bonuses (free night certificates) in December and we had already picked out September or October as our target date range. It’s a good time to visit Hawaii and it’s also a relatively slow time for me at work. A 9-10 month lead time would also improve our chances of finding free nights and flights that all worked together.

- Free hotels. There were multiple options for airlines and frequent flier programs to get to Hawaii, but we were aiming for two specific hotels with limited award night availability. I knew that hotels would be the limiting factor, so that’s where I started. The hotel availability was so limited that I didn’t even look at flights at all until I had the hotels set. The free night certificates are completely refundable, so there was no risk to booking them “in the blind” as far as airfare was concerned.

- Free flights. Once I locked down hotel reservations and used all 6 certificates, I began the flight search. I checked my usual three: United, American, and Delta. Right away I noticed that most flights from the lower 48 to Hawaii arrive in the evening, and most return flights are red-eyes. That threw a wrench in the plans because I didn’t want to waste virtually the whole first day at one of the awesome hotels by getting in late. So I moved my search for the outgoing flight up a day and figured we could stay the first night in an inexpensive hotel by the airport. I settled on a Delta round trip, which would use up our entire Delta SkyMiles balances. (good riddance!)

- Bonus night. Because we would be arriving a night early, we would need to find a hotel for that first night. I had recently seen an e-mail offer for bonus American Airlines miles when booking hotels through Rocketmiles. I found a decent-looking hotel near the airport in Kahului and booked it through Rocketmiles for the bonus miles.

- Car rental. We waited a little too close for comfort on this. I think we reserved a rental car less than 2 months from the trip. It ended up working out fine, but we should have taken care of it earlier, to be safe.

The struggle with free nights at the Andaz Maui

Certain Hyatt resorts are notorious for being difficult to book with points or free night certificates. There’s a whole Flyertalk thread devoted to this annoyance. It’s a combination of supply/demand, games some hotels play with room types, and minimum stay requirements. The Andaz Maui at Wailea ranks up their with the worst of them, as it has all three factors going for it.

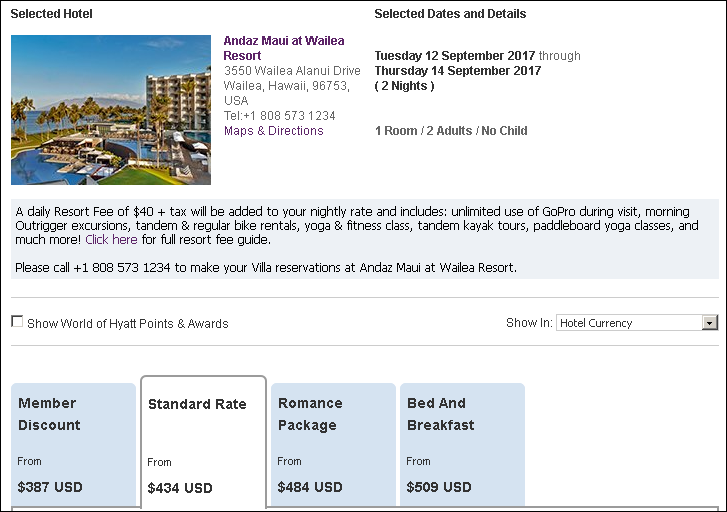

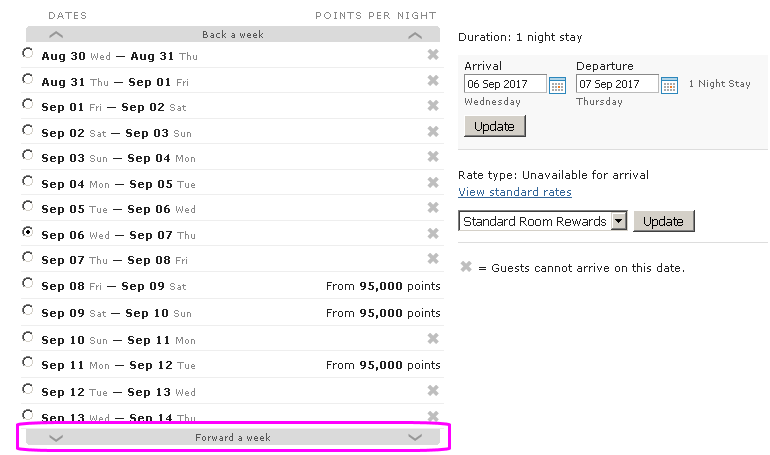

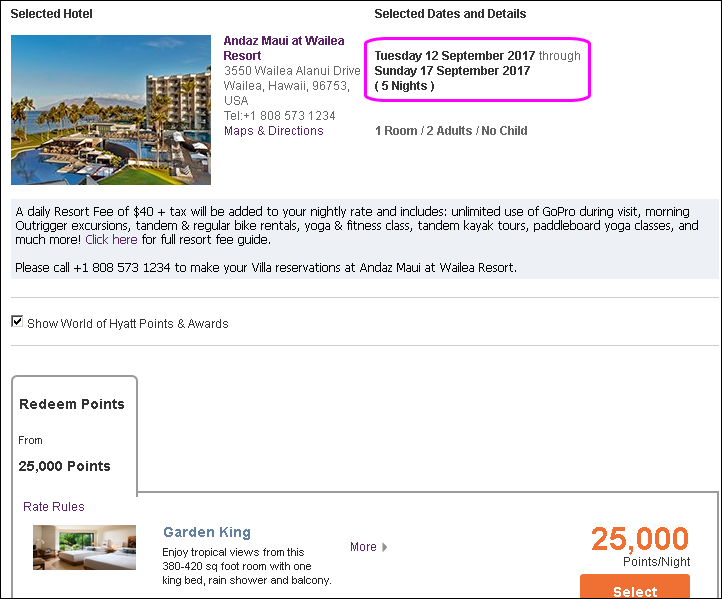

Example: If I try to book for two nights this coming September, it shows standard rooms available:

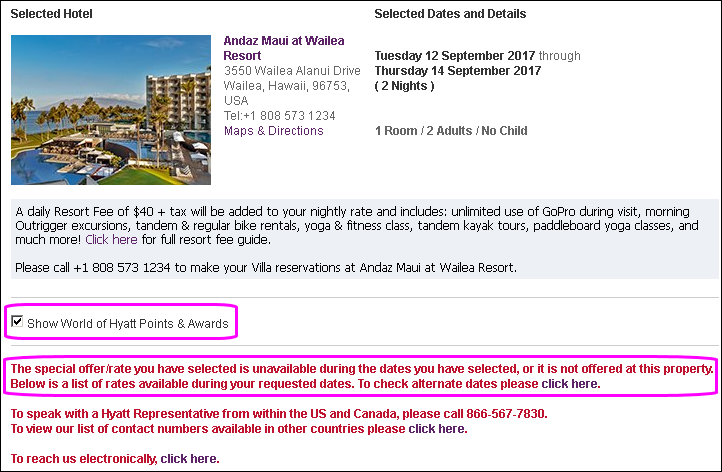

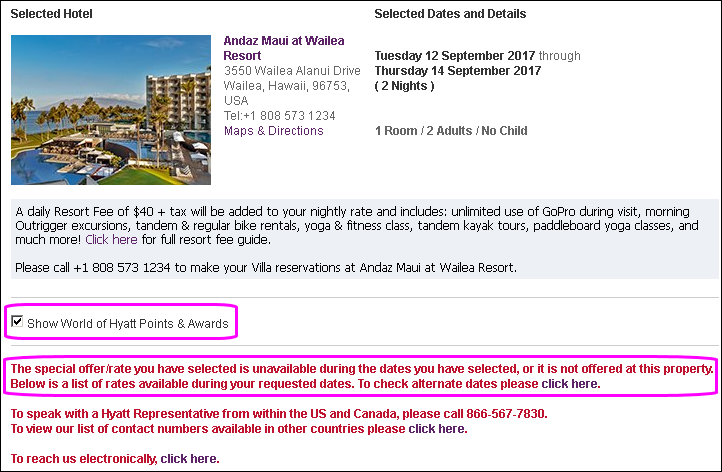

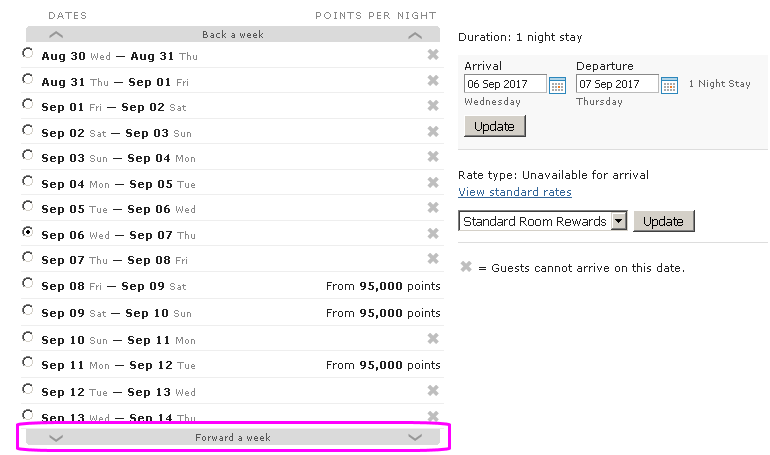

Check the box for paying with points and the rooms disappear:

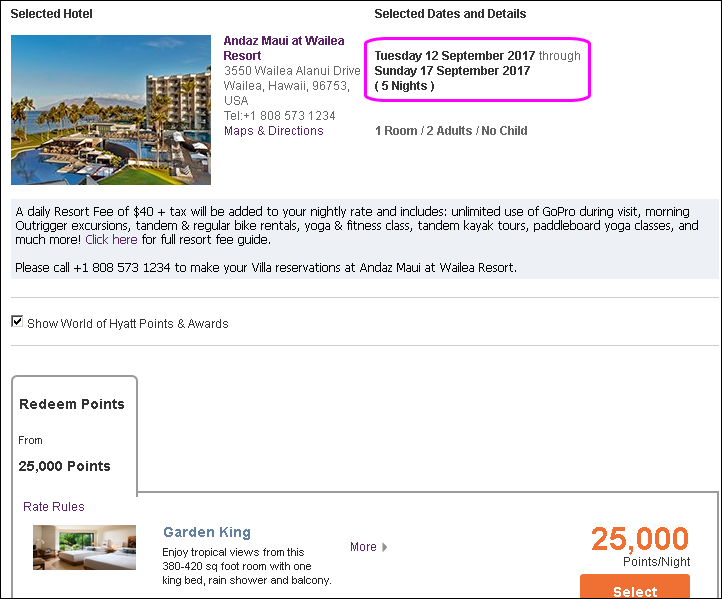

But, if you extend the stay to 5 nights, the rooms are magically available again. This is an example of a hidden minimum stay requirement:

The minimum stay requirement in the example above is probably the one that gets most people. The minimum stays aren’t publicized; you just have to search around for room availability. Some dates it’s 5 nights minimum, others it’s 2, or any other number.

Free night certificates can only be used to book “standard” rooms, which are the same ones bookable with points. This is another way some Hyatts manipulate room availability. They re-categorize a handful of rooms to a “lower” room type and calling that new type the “standard” room. This new room type can exist for reasons such as a less desirable view or being on a lower floor. I call shenanigans!

How we beat the shenanigans and booked the room

With a little help from reports on Flyertalk and blog posts like this one from Million Mile Secrets, I went to book our free rooms. The Hyatt website was giving us the same minimum stay error for our selected dates as shown above. I was anticipating that so I had Nicoleen call the Hyatt Gold Passport reservation line.

The rep put up a little resistance when the same online system didn’t let him book Nicoleen’s 2 night stay with her certificates from her Chase Hyatt card. She played dumb and told him that each night showed up as available when she selected cash as the payment type. And, she reasoned, if the same room type was available with cash, she should be able to book it with her certificates. She was successful. Two down, two to go!

Next It was my turn. I tried the same thing but the rep I got actually cited the 5-day minimum stay. I told him as long as the standard room was available (which it certainly was), I should be able to book it with my certificates. He once again mentioned the 5 night minimum so I had to play my ace: “If it’s not possible, then how did my wife just book the two previous nights? Here’s her confirmation number…” The rep put me on hold and after about 10 minutes a manager greeted me. She said usually it’s not possible, but in this case she would make an exception and book the room for me.

The Andaz Maui at Wailea is such an amazing property, it was worth the extra hassle to hunt and fight for the free night reservations.

Apparently there is a way for the Hyatt customer service reps to book free nights and override the individual property’s minimum stay limit. It might take a few HUCAs (Hang Up and Call Again) but it can be done. Or at least it could be done when we booked this trip. This type of thing is constantly evolving and I would recommend reading recent discussion in the Flyertalk forum for the latest intel.

Booking the Hilton free nights

Using the Hilton free nights from the Citi Hilton Reserve card is actually more restrictive than the Hyatt certificates, but it’s more cut and dry.

Hilton also limits their capacity of points-bookable rooms. On top of the limited supply, they further limit the number of points-bookable rooms at the “standard” award level. These are the equivalent of an airline’s “saver level” award seat. Only the standard room type at the standard award level can be booked with the Citi free nights. One more restriction: the Citi free nights can only be used on Fridays, Saturdays, or Sundays.

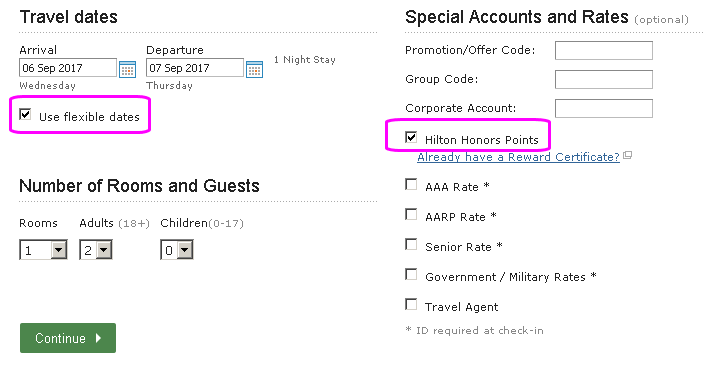

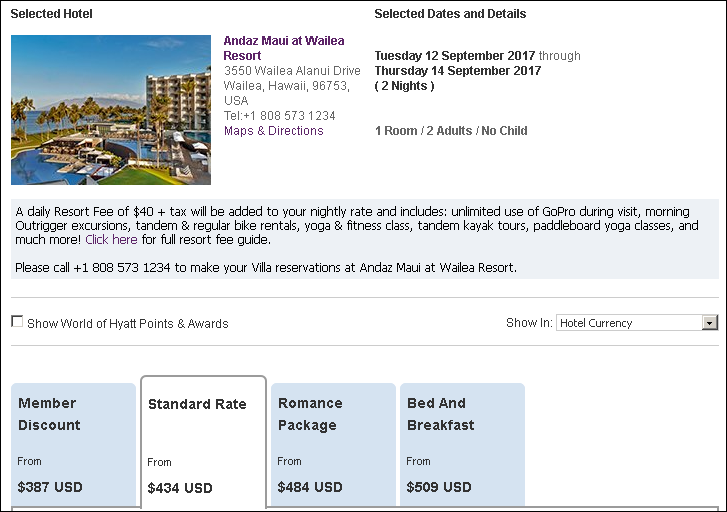

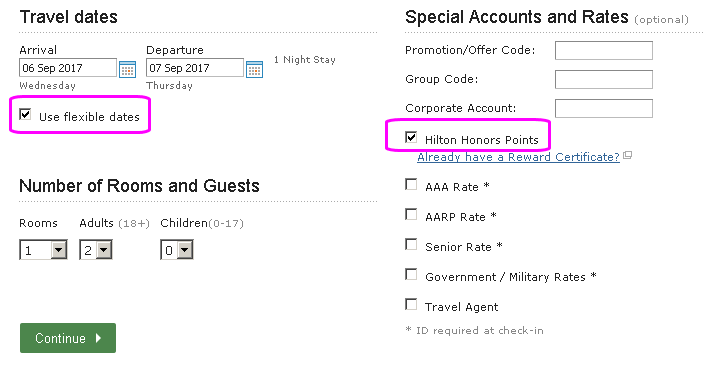

Despite the restrictions, it’s easy to search for available dates. When searching for a room on the Hilton website, check the “flexible dates” and “Hilton Honors points” boxes:

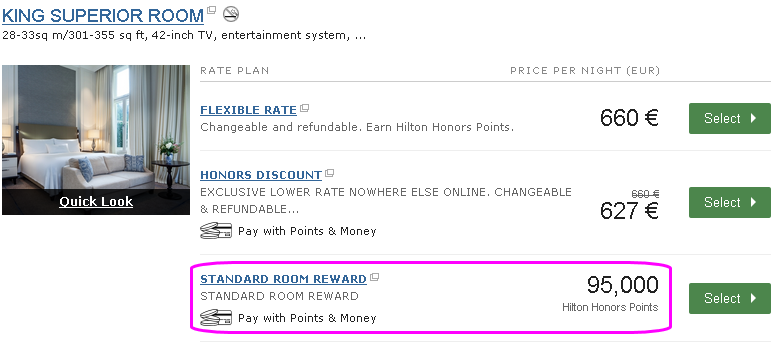

The results will look like this:

You can then click “Forward a week” to scroll through the dates. Standard award rates are always nice round numbers. In the Grand Wailea’s case, it’s 95,000 points. As of right now, September 8th-10th, 2017 is an available weekend stay!

Before booking the Hyatt nights, I had confirmed that the two days following that hotel stay were available weekend nights at the Grand Wailea at standard rates. A few clicks later, and both hotels were booked!

Free airfare (the easy part)

By the time I got all the hotel stays to line up, our dates were the only stretch in our 2 month window that would work. Being tied to specific flight dates typically makes finding free flights more difficult. But we had a few factors working in our favor as well. We had decent balances in all three major U.S. frequent flier programs (United, American, Delta), Hawaii is a popular place to fly, and we were starting our search 9 months in advance.

Right off the bat our specific travel dates narrowed us down to Delta flights. Nicoleen and I had over 90k combined Delta miles. Since Delta has the worst redemption rates in the universe for award flights, our round trip economy flights would cost us 45k miles per person.

The other option was to transfer Chase Ultimate Rewards to Korean Air and book the exact same Delta flight for 25k miles per person. (For a full explanation of how this works, check out this post by Milevalue: Guide to Booking Delta Flights to Hawaii for 25k Korean Miles Roundtrip).

Despite living near a Delta hub (MSP) I value Delta Skymiles so lowly, I had previously resolved to use them the first chance I could. So I gave up a potential 50,000 point savings on a 90,000 mile flight in order to get rid of my Delta balance! I had to pay a $120 fee to transfer some of Nicoleen’s miles to me so we both had over 45k. . . and I still think I made the right choice!

My complimentary meal on the 5 hour flight LAX-OGG. The price of flying for free. 🙂

Cost Breakdown

Airfare:

Our outgoing and return Delta flights were both two-leg economy flights with a layover at LAX. The cash value was actually pretty reasonable at $605.01 per person, round trip. We paid 45k Delta Skymiles per person. There was a $120 transfer fee involved in order to get both our account balances up to 45k. We also paid $25 each way to check a bag.

We earned the majority of our Skymiles with the Delta Gold American Express card, which we both got early in our credit card careers.

Lodging:

We stayed the first night of our Hawaiian get-away at the the Maui Seaside Hotel. When all was said and done, it cost us $179. With the stay we earned over 4,179 American Airlines Miles, which is worth at least $50 to me.

Our next 4 nights were at the Andaz Maui at Wailea. We used 4 free night certificates that we earned by each getting the Chase Hyatt card. The cash price for a fully refundable stay at the time we booked the room was $439. With the mandatory valet fee ($25), daily resort fee ($40), and tax, the nightly total would have cost us $540, for a total of $2,160. The resort fee is covered with the free night, so all we had to pay was the valet fee, $106!

The last two nights of the trip were at Hilton’s Grand Wailea, a Waldorf Astoria Resort. The cash price for our room at the Grand Wailea was $327. With resort fee, valet, and tax, two nights would have been $872. Our cost was just the valet with tax: $62.50!

Ground Transportation:

We decided to see what the smaller, non-chain car rental companies had to offer on Maui. Our search revealed some amusing results. One particular company had a category called “old vans” which consisted of early 90’s minivans at a bargain price!

We went with a company called Maui Car Rentals that had Mustang convertibles for less than the price of compact economy cars at the major chain rental agencies. I got this 3-5 year old Mustang convertible that ran and looked great for $223! We got a free ride from the airport and they let us drop the car off at the airport after hours. Maui Car Rentals nō ka ’oi!

We had a running joke with the hotel valet drivers. When requesting our car we told them we had the white Mustang convertible. I think about 90% of the cars on the island were white Mustang convertible rentals!

Conclusion

This Hawaiian get-away for Nicoleen and me was the culmination of a lot of planning. We had this or a similar trip in mind way back when we planned our credit card applications a year prior. The Chase Hyatt card and the Citi Hilton Reserve cards make a potent combination if enough advanced thought it given to the bonus redemptions. For us, the research and planning paid off!

We managed to stay at luxury resorts on Maui that we could have normally never afforded. Throw in the virtually free airfare and the whole trip cost us less than a budget weekend to Florida would have cost!

Another added bonus of virtually free airfare and hotels is the freedom it affords you with other spending. You can splurge on dining and entertainment and not feel guilty about it.

Lobster deviled eggs, Proletariat wood-fired pizza, and the best fries on the planet – at Monkeypod farm-to-table restaurant in Wailea, Maui.

Do you want to learn the tactics we used to plan and execute this amazing Hawaiian get-away? Like the ValueTactics Facebook page, comment, ask, and interact!

For more on this Hawaiian get-away trip, check out these related posts:

Citi’s AAdvantage Platinum Select MasterCard currently has an increased sign-up bonus of 60,000 American Airlines miles. The usual bonus is 40,000. To get the bonus miles, you must spend $3,000 in the first three months. The $95 annual fee is waived the first year.

Citi’s AAdvantage Platinum Select MasterCard currently has an increased sign-up bonus of 60,000 American Airlines miles. The usual bonus is 40,000. To get the bonus miles, you must spend $3,000 in the first three months. The $95 annual fee is waived the first year. Another update, another excuse! 🙂 I have acquired a key piece of equipment I need to produce high quality videos. However I haven’t managed to acquire the time needed to put it to use. I promise you, as soon as I’m able I will start releasing useful and entertaining videos for you to watch and share!

Another update, another excuse! 🙂 I have acquired a key piece of equipment I need to produce high quality videos. However I haven’t managed to acquire the time needed to put it to use. I promise you, as soon as I’m able I will start releasing useful and entertaining videos for you to watch and share! – Keep or Cancel: Some Examples is a great post for helping you decide whether to keep a credit card when its annual fee is due. It’s impossible to cover every variable for every situation, but this post shows some examples of how I work through the decision.

– Keep or Cancel: Some Examples is a great post for helping you decide whether to keep a credit card when its annual fee is due. It’s impossible to cover every variable for every situation, but this post shows some examples of how I work through the decision.

Between two people you’ll have a total of 8 free nights if each of you gets both cards. It’s a little tricky though, because the Hilton free nights are only good on weekends (Fri, Sat, Sun nights). So in order to get 8 nights in a row, you’d have to split your stay at the Hilton in two, with the 4 Hyatt nights in between. We had no interest in switching hotels twice, so our goal was 6 nights split between 4 Hyatt nights and 2 Hilton nights. (We had to do this anyway since I had already used both free nights from my Hilton card on previous trips).

Between two people you’ll have a total of 8 free nights if each of you gets both cards. It’s a little tricky though, because the Hilton free nights are only good on weekends (Fri, Sat, Sun nights). So in order to get 8 nights in a row, you’d have to split your stay at the Hilton in two, with the 4 Hyatt nights in between. We had no interest in switching hotels twice, so our goal was 6 nights split between 4 Hyatt nights and 2 Hilton nights. (We had to do this anyway since I had already used both free nights from my Hilton card on previous trips).