Our free stay at the Hilton Amsterdam was a nice little bonus at the tail end of our anniversary vacation. I wanted to get our return flight out of Frankfurt but there was nothing available in our date range. I expanded the flight search to nearby airports and found a flight out of Amsterdam. The flight left around noon so I figured a hotel stay nearby would make getting to the airport less problematic. We didn’t want to risk missing the flight due to last minute ground transportation problems.

I had two free nights at any Hilton that I earned with my Citi Hilton Reserve card, so the extra night of lodging wouldn’t cost us anything. As a bonus, we would get to experience a new city and add another country to our trip!

Hotel Overview

The Room

Executive Lounge

Dining

Cost and Value

Overall Thoughts

This post is part of a series reviewing our 2015 Anniversary trip to Europe. For a full list of the posts in this series, and for an overview of the trip, check out the index page.

Hotel Overview

The Hilton Amsterdam was the first international hotel built in The Netherlands. It’s an 11 story V-shaped building in a quiet part of the city, away from all the tourist traps. The hotel has some interesting history; notably it was the site of John Lennon and Yoko Ono’s “Bed-In” for peace in 1969. For more general info on the Hilton Amsterdam check out the hotel’s heritage page or its Wikipedia page.

The Hilton Amsterdam is currently rated 4.5 out of 5.0 on Tripadvisor and is ranked #42 of 364 hotels in Amsterdam.

The Room

Due to my Gold status with Hilton HHonors from my Citi Hilton Reserve card, we got a free room upgrade at check-in. Our room was an “Executive King Room” on the 8th floor, which was dedicated to executive rooms. Our room key also granted us access to the 10th floor, which is entirely taken up by the rooftop executive lounge. More on that later . . .

Our room was impeccably clean. It looked like it was recently renovated as well. A clean, newly renovated room will get a great review from me every time! Our executive king room at the Hilton Amsterdam was large enough for our needs and had a convenient lay-out. The view of the city was fantastic. Overall we were very pleased with the room.

The top shelf was the only usable space for personal items in the minibar fridge. The other items were automatically charged to the room upon removal. Be careful!

The complimentary bottles of water we got as a Gold Status perk. The Hilton pen that was by the note pad was the nicest hotel pen I have ever pilfered (until the Grand Wailea, that is).

Executive Lounge

One of the reasons I chose the Hilton Amsterdam among the other Hilton properties in the city was the executive lounge. Gold status gets you access to these lounges at any Hilton that has one.

After getting settled in our room we headed up to the rooftop floor. The executive lounge is the only thing on the top floor, and only executive floor room keys will get the elevator to stop there. The lounge was open from 6:00-9:00 in the evening, daily. We arrived right at 6:00 so we got the first pick at the assortment of complimentary food and beverages.

Poor Nicoleen was 7 months pregnant, so she couldn’t take advantage of all the complimentary beer and wine that were available in parts of our trip. Pictured here, she finds solace in a carrot chip.

Besides the food and drink, there were newspapers available. The views of the city were beautiful, and overall the place had a very relaxing ambiance. Most of the other guests appeared to be traveling on business. I guess that fits the “executive” part.

I would have been happy to fill up on the free beer and hors d’oeuvres, but Nicoleen wanted to get a flavor of the city, so we headed out for supper.

Dining

The Amsterdam Hilton has three restaurants, a bar, and a fitness center. The restaurants looked top notch, but we had other plans for dinner. The one evening was the only chance we had to soak up some Dutch culture so we wanted to find out where the locals ate.

The great thing about the Hilton’s location is that it’s far from the tourist-trap center of the city. A short walk from the hotel and we were surrounded by locals. We found a small French café and ate a light dinner, which was enough after we had partially filled up on appetizers in the executive lounge.

Breakfast Buffet

Our gold Hilton status got us free breakfast at the buffet. This was normally $30 per person so it was quite a good value! The host seated us at a table and took our drink orders. Thirty dollars for a hotel breakfast seemed a bit steep until we saw the wondrous cornucopia that awaited us!

The spread at the Hilton Amsterdam was probably the most extensive breakfast buffet I have ever seen. It had anything you can think of from multiple cuisines. There was the full European spread: multiple breads, meats, and cheeses; müsli, sweet bakery goods, and boiled eggs. British specialties like veal sausage, tomatoes, and mushrooms were on hand as well. There were French crepes and omelettes made to order. The whole American breakfast experience was available too: bacon, sausage links, scrambled eggs, fruit, cereal, biscuits and gravy, etc. There were even African and Asian dishes that I didn’t recognize at all.

It was like having several breakfast buffets from multiple continents, all combined into one!

On the way out, there was a table with to-go options. That’s rare at a buffet! There were little paper cartons you could fill with tiny muffins or fruit, and to-go coffee cups as well. That’s awesome service right there!

The to-go goodies I grabbed on the way out of the buffet. “Have a nice day”. . . don’t mind if I do!

Cost and Value

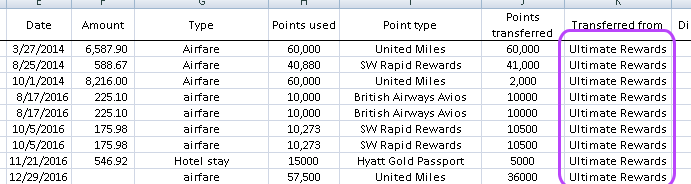

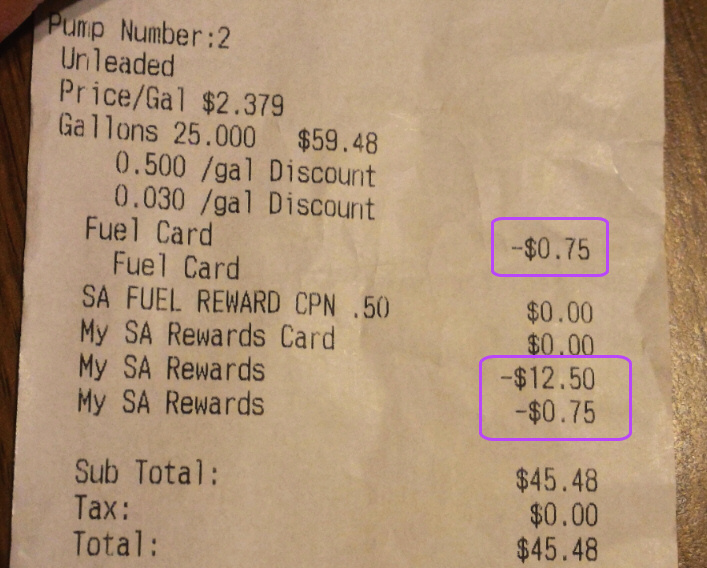

Our executive level room at the Hilton Amsterdam was a steal at $0.00! I used one of my two free weekend night certificates on this hotel stay. My gold Hilton status and the free night certificates are some of the perks of the Citi Hilton Reserve card, which I had opened a few months prior to planning the trip.

Had we paid cash for the same room at the time of booking, it would have cost $385.48. I wrote above that the buffet breakfast was $30 per person. But if we would have added the breakfast onto our booking as a package, it would have been an extra $20.47. That brings the total value of our free stay to $405.95. Not a bad deal for half of a credit card sign-up bonus!

Overall Thoughts

Our one night stay in Amsterdam could have been purely functional; it served the purpose of getting us close to our departure airport. The Hilton turned our 16 hours in The Netherlands into much more than that. It was a fun and refreshing finale to our anniversary trip!

All the staff at the Hilton were extremely courteous and professional. I don’t know how much of it was due to our gold status, but we received white glove service throughout our short stay. (No, really . . . the doorman was wearing a tail coat and white gloves!) Like everyone else in Holland, the hotel staff all spoke perfect English. The concierge helped arrange a taxi for us to get to the airport in the morning and everything went smoothly.

There were plenty of other hotel choices in the city. Had we been paying cash for the room we would have probably chosen something cheaper and closer to the airport, but I don’t think the Hilton is overpriced for the service and room quality they offer. It’s a clean, beautiful hotel in a beautiful, vibrant city.

🙂 Thanks for reading my review! 🙂

(This was actually my second choice for using my Hilton free night in Amsterdam, but that’s another story for another blog post. . . )

(This was actually my second choice for using my Hilton free night in Amsterdam, but that’s another story for another blog post. . . )