Last month Nicoleen, I, and the 4 oldest kids embarked on our first real family vacation. We anticipated some challenges in traveling with 4 kids aged 8 and under, so we planned a pretty simple and straight forward trip. The plan was for 5 days and 4 nights in the Black Hills of South Dakota. We wanted to camp primarily, but I couldn’t in good conscience plan a whole vacation without getting something for free, so we looked for a hotel in Rapid City where we could recharge after our first day which would mostly be spent in a cramped car.

THE PLANNING PHASE

After the fun traveling Nicoleen and I have done over the past couple of years, we thought the kids deserved to get in on some of the action too. They are ages 8, 6, 4, 2, and <1 so they are just getting to the age where they will appreciate and remember their travel experiences. We figured for our first attempt at a family vacation we should do something simple, so flying and dealing with a rental car were out of the question.

We also didn’t want to push our luck on duration, so we settled on a long weekend trip. Pretty early on in the planning discussions we decided to leave the baby with grandparents. She would not enjoy the trip, would be a hassle and a half for us, and would take up a lot of space in the car with all her baby gear. That left us with 2 adults and 4 kids in a Honda Pilot; cramped, but manageable:

Living in the Minneapolis area, South Dakota seemed a logical choice. There’s plenty of stuff to do in any kind of weather, and the 10-11 hour drive is short enough to make in a single day, yet it puts you far enough away to really get away and change the scenery.

THE PLAINS AND BADLANDS

The kids were a bit restless on our long drive from eastern Minnesota to western South Dakota. I will definitely have to spend more time reading Mommy Points and Points with a Crew for some tips on traveling with kids. By the time we reached the Badlands we were all ready to stretch our legs and burn off some energy. We took the Badlands loop highway (Hwy 240) and got out to climb around a bit. The heat in early June was downright oppressive.

RAPID CITY

The first night of our trip we stayed at the Holiday Inn at Rushmore Plaza in Rapid City. Click here for a full review of the hotel and for some of my logic on choosing it. We arrived long after the kids’ bed time and had a challenge getting the little buggers to sleep in our oversized room. But eventually they succumbed:

Those are some tuckered out kids!

The hotel was more than we expected in terms of amenities, cleanliness, and decor. Read the COST BREAKDOWN down below to see what a deal we got (HINT: it was free!)

BLACK HILLS

Overall the Black Hills is a wonderfully diverse and accessible area for kids and adults alike, with plenty of variety in recreation opportunities. I had been to the Black Hills several times as a kid, and Nicoleen and I went there together in 2004. For the main segment of our trip we set a few ground principles:

- We won’t try to see everything in one trip. First of all it’s impossible. Second of all, it relieves the pressure to make it to any given attraction; we can always hit it the next time we’re here.

- We won’t plan our days in advance. Especially because the kids are along, we need to stay flexible. This will also help us deal with any bad weather we might get. Having one or two rainy day activities in the hopper at any given time will help greatly if the skies don’t cooperate.

- Let’s not fill up every day with activities. The campground has a pool and lots of rocky areas to explore. The kids will have just as much fun roaming around as they will on a structured outing, and mom and dad will probably need some down time to just sit and have a beer.

These principles ended up being pretty helpful. Of course we did a few of the must-see attractions like Mt. Rushmore, the wildlife loop at Custer State Park, and Needles Highway.

The whole family (less the baby), squinting for the camera at Mt. Rushmore. It was in the upper 90s by noon.

Rushmore cave

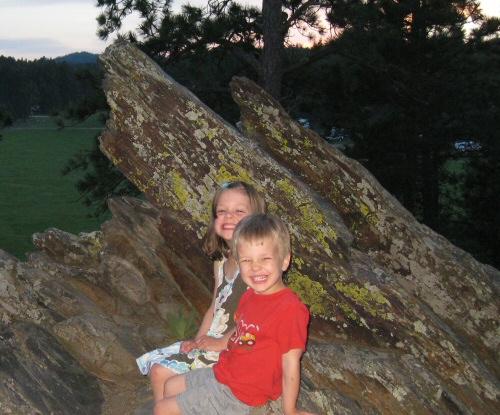

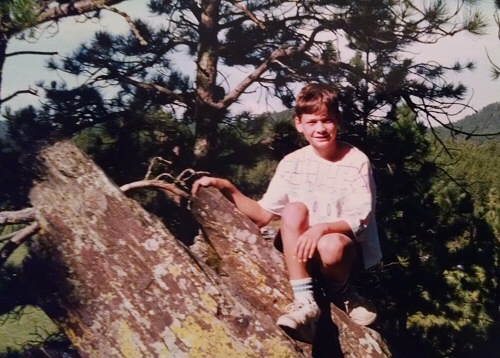

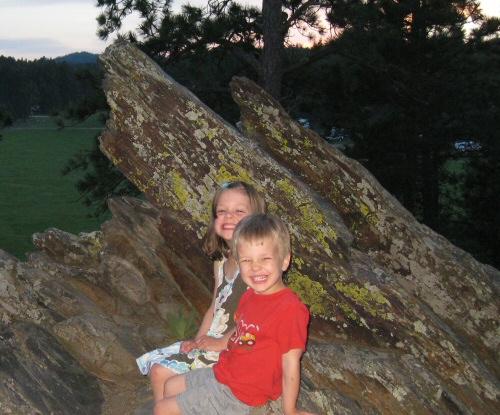

. . . but the kids’ best memories of the trip will probably be of swimming at the campground pool, climbing around the rock outcrop behind the campsite, swimming, meeting little friends from neighboring sites, and swimming.

RAFTER J-BAR RANCH CAMPGROUND

For our three nights in the tent, we chose Rafter J-Bar Ranch Campround outside of Hill City, SD. I have stayed at Rafter J-Bar on most of my previous Black Hills trips and year after year it continues to deliver.

We stayed in the main camp, at site #2, which is right across the road from the office/store and pool. The whole place is very clean and well taken care of. Our site with no electric was $43.95 +tax per night. That’s spendy for a tent site, but still cheaper than a hotel.

Nicoleen and I were disappointed to find out that the campground was no longer a “ranch campground,” as they emptied the stables several years ago and no longer offer trail rides. However, we were happy to see that not much else has changed. The staff is still friendly, the pool is still wet, and kids still enjoy exploring the natural areas.

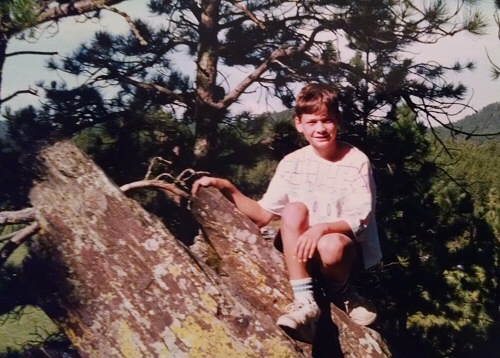

Rocks don’t change. Me in 1994 and my kids in 2016!

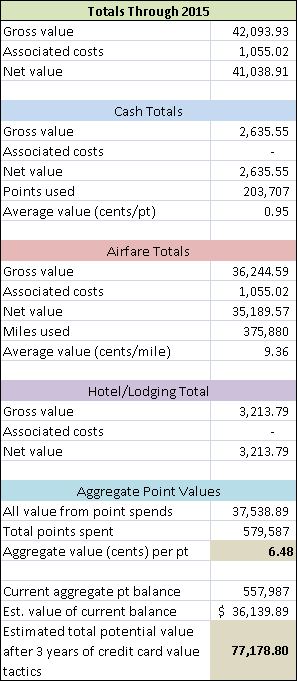

COST SUMMARY

Lodging (hotel): $0.00

Lodging (camping): $139.10

Fuel cost: estimated $175

Food, Shopping, Entertainment: estimated (very ballpark) $300

Total cost for 4-night road trip to South Dakota: ~$604.10

Savings from using value tactics: at least $215.55

COST BREAKDOWN

Although this trip didn’t utilize a lot of free travel tactics, we used value tactics throughout. We put all our spending on credit cards to earn more points and miles and we bought a cooler full of food before we left home, to keep our dining costs down. We also realized that with all these young kids along, simple activities like the swimming pool and campfires would be just as fun for them (and free) than trying to cram every day full of paid entertainment.

Travel Cost:

Nicoleen’s loaded down Honda Pilot got around 17-18 mpg on average. The constant air conditioning and many hills brought the fuel economy down. We spent about $175 on gas. There weren’t any Super Americas along our way, so we were unable to utilize our normal free gas tactics.

Nicoleen’s loaded down Honda Pilot got around 17-18 mpg on average. The constant air conditioning and many hills brought the fuel economy down. We spent about $175 on gas. There weren’t any Super Americas along our way, so we were unable to utilize our normal free gas tactics.

Lodging:

The campground was $139.10 for three nights. This seems expensive for camping but it’s a tourist area so all the rates are higher. Even so, it’s not a bad price for 3 nights’ lodging for 6 people! The hotel was a different story: we got a room that retails for $215.55 and paid $0.00 for it! It cost us 35,000 IHG points, for a redemption value of 0.62 cents per point. Not a very good rate, but it was still nice to get the hotel at no cost!

Food, Shopping, and Entertainment:

This part is very subjective and reporting my costs here is pretty meaningless. You can spend what you want on these parts of the trip. We were pretty frugal and only spent around $300. It seemed like we got little snacks along the way whenever we wanted, so in that sense we didn’t hold back. But I think bringing that huge cooler full of food and drink really helped this cost stay down.

OVERALL this was a very fun trip! The kids were a challenge sometimes but I think they really got a lot of good memories out of the deal. Road trips are hard to work value tactics into, but the free night at the hotel was definitely a welcome segment of the trip.

Nicoleen’s loaded down Honda Pilot got around 17-18 mpg on average. The constant air conditioning and many hills brought the fuel economy down. We spent about $175 on gas. There weren’t any Super Americas along our way, so we were unable to utilize our normal

Nicoleen’s loaded down Honda Pilot got around 17-18 mpg on average. The constant air conditioning and many hills brought the fuel economy down. We spent about $175 on gas. There weren’t any Super Americas along our way, so we were unable to utilize our normal